Barring any last-minute change, MRS and other partners of the Dangote Petroleum Refinery are set to begin selling petrol at N739 per litre.

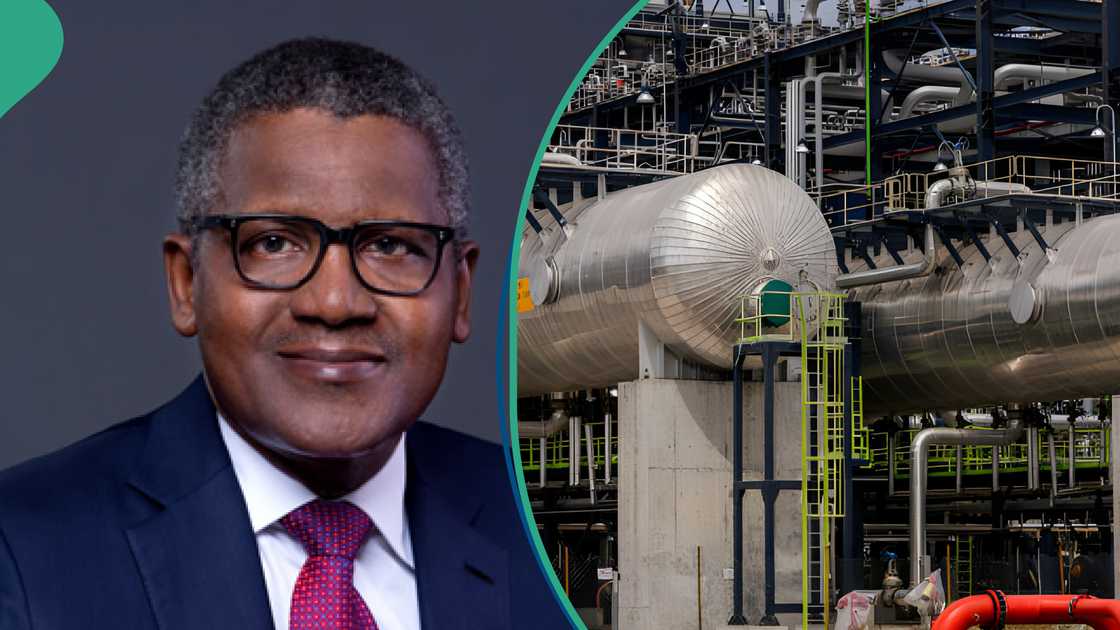

This comes two days after the refinery slashed its petrol gantry price from N828 to N699 per litre. Speaking at a press briefing at the Lekki refinery on Sunday, the President of the Dangote Group, Alhaji Aliko Dangote, said he was aware that despite lower gantry prices, some filling stations often choose to keep pump prices high, thereby sabotaging his efforts.

According to him, MRS would commence the sale of petrol at N739 per litre from Tuesday, while other partners would follow. Dangote alleged that some officials had met with certain marketers and encouraged them to keep prices high in order to frustrate the price reduction, stressing that he would fight to enforce the new price regime.

“I was told that the marketers have met with (some officials) and were told to make sure that the price is maintained high. But this price we are going to introduce, we are going to start with MRS stations most likely on Tuesday in Lagos; that N970 per litre, you won’t see it again. We have also asked members of IPMAN to come now.

We have asked anybody who can buy 10 trucks to come and buy 10 trucks at N699.

“We are going to use whatever resources that we have to make sure that we crash the price down. We will get these sales; maybe it will take us a week to 10 days. But first of all, within a week to 10 days, we will be able to deliver. For this December and January, we don’t want people to sell petrol for more than N740 nationwide. Those who want to keep the price to sabotage the government, we will fight as much as we can to make sure that these prices are down. That’s not the price. If you have money to come and buy, you can pick up petrol at N699,” he said.

Dangote said transporting petrol from the refinery costs no more than N15 per litre, questioning why pump prices would rise as high as N900 per litre. He also accused the Nigerian Midstream and Downstream Petroleum Regulatory Authority of issuing 47 import licences to bring in more than seven billion litres of petrol in the first quarter of 2026, a move he said was killing local investments.

“Freight within Lagos is N10 or N15, maximum. So if it’s N10 to N15, everything is going to cost you N715. Why do you want to sell at N900? People should get the real price. I cannot come now and take the hit. Did we make money? No, we didn’t make money. But as we speak now, even our tanks are full because the NMDPRA has issued reckless licences. And we have to now go and complain to the government.

“They normally issue licences in the middle of the month. So, they are now ready to issue licences for about 7.5 billion litres for the first quarter of 2026, despite the fact that we have guaranteed to supply enough quantity.

“If you are talking about monopoly, did we stop anybody? They issued 47 licences. Let those people come and put up a refinery here, or let them go and buy even NNPC’s and operate them. If it’s profitable, they should go and do that now. NNPC was the only business that was bringing in fuel before.

“Now, we are the only one and one of the few modular refineries that are producing. Those modular refineries, I can tell you for nothing that they are almost on the verge of collapse. None of them is making a dime,” he added.

The billionaire businessman assured Nigerians that the N739 per litre price would be enforced, beginning with MRS stations on Tuesday. “Starting from Tuesday, MRS will start selling petrol at N739/litre. Definitely, we will enforce that low price. We will make sure that it’s implemented. If you have your truck, you can come here and buy it. We are selling at N699. The N699 includes the percentage of NMDPRA. So what actually comes out to us is about N389 or so,” he stated.

Contacted for his reaction, the NMDPRA spokesman, George Ene-Ita, said, “For now, no comment.”

punch.ng

FOLLOW US ON: