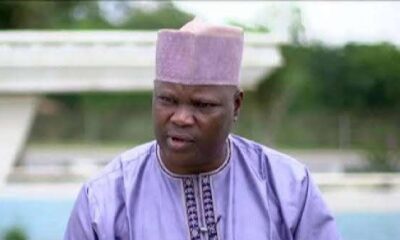

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, has assured Nigerians that the country’s economy has turned the corner.

He stated that in an opinion released on Sunday titled “Nigeria turning towards prosperity”, reassuring the citizens that the worst days were over.

“Despite some historical shortfalls and present-day challenges, I believe the most difficult phase of our economic journey is behind us. Nigeria has turned a decisive corner. The road ahead will demand hard work and discipline, but we are firmly on the right path,” Edun asserted.

According to the minister, when President Bola Tinubu took office in 2023, the country’s economy was on the brink of fiscal collapse.

“Slowing growth, surging inflation, and market distortions like the fuel subsidy and multiple exchange rate regimes had created an environment that scared off investment.

The President’s mandate was clear – dismantle those market distortions, reward productivity, and create a climate where private investment can thrive.

“Two years later, the results are evident at the macro level. GDP grew by 4.23 per cent in the second quarter of 2025. Inflation, while still high, has moderated to 18.02 per cent after six consecutive months of decline.

“The exchange rate has stabilised, and the gap between official and parallel markets has narrowed to about one per cent, down from a peak of nearly 70 per cent. Importantly, foreign reserves have risen above $43bn, the highest since 2019. These are more than just numbers; they are the foundation for building inclusive growth that benefits every Nigerian,” Edun enunciated.

President Tinubu, during his inaugural speech, announced the end of the petrol subsidy regime, which was said to be shrouded in corruption.

Consequently, the average price of a litre of petrol jumped from approximately N238.11 on May 28, 2023, to over N500 per litre on May 30, 2025.

A litre currently sells for between N910 and N950, depending on the location across the country.

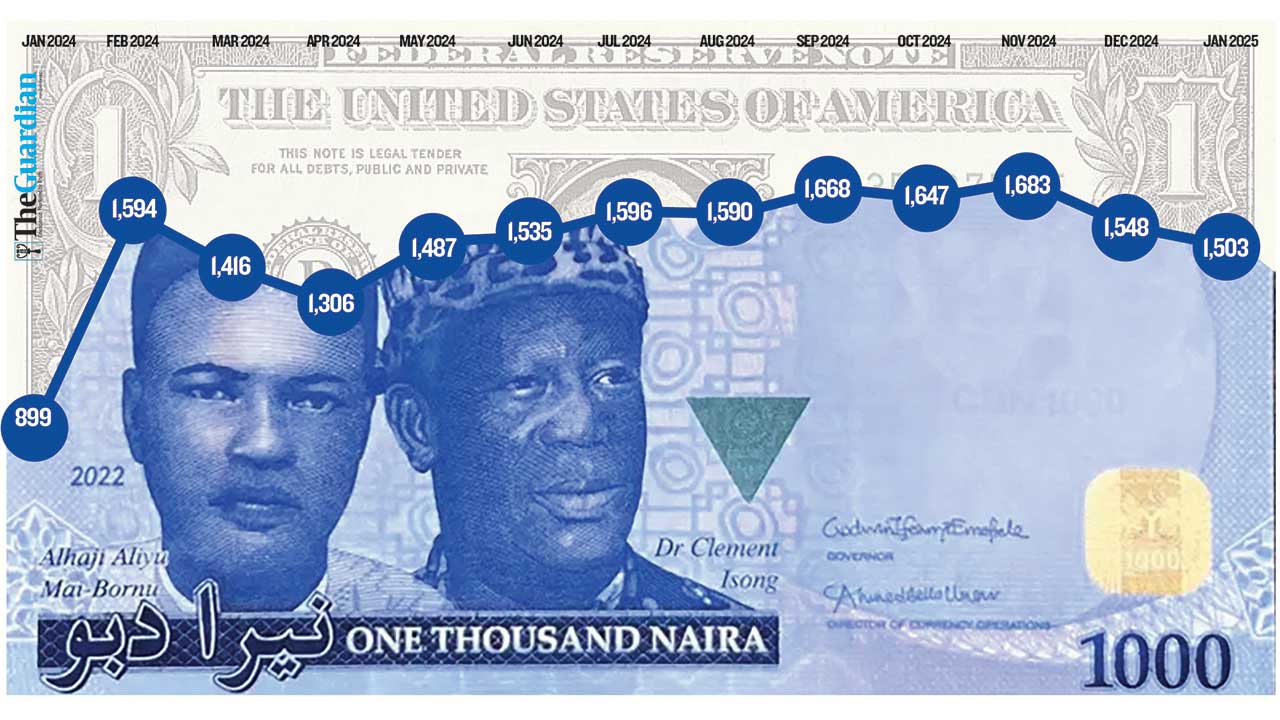

In June 2023, the Central Bank of Nigeria unified the country’s exchange rates. As a result, the naira depreciated significantly, dropping from approximately N460–N465/$1 in the official market and N740–N775/$1 in the parallel market in May 2023.

By May 2025, the exchange rate had fallen to around N1,590.74/$1 in the official market and N1,620/$1 in the parallel market.

However, the local currency has gained almost seven per cent to trade at N1,457.96/$1 as of October 24, 2025.

The finance minister alluded that the economy “is ultimately about people, not statistics”.

“Millions of Nigerians measure progress by the cost of food, transport, and other necessities. I am keenly aware of this reality.

“Food inflation has been our heaviest burden since it surged after currency depreciation and the removal of fuel subsidies. However, targeted measures are beginning to ease the pressure. A bag of rice that cost about N120,000 last year now averages around N80,000. The prices of garri, pepper, tomatoes, and other essentials have also decreased,” he mentioned.

He explained that the government had taken steps to ensure the prices of food continue to trend downward, noting, “At the same time, we are careful to ensure our smallholder farmers have enough incentives to return to farms next planting season.

“We are, therefore, implementing programmes that stimulate agricultural production by safeguarding smallholder farmers’ incomes.

“In addition, 8.1 million households nationwide have received direct cash support from the government to help meet basic needs. This is more than a safety net; it ensures that the impact of these necessary reforms is cushioned for the most vulnerable among us, even as we continue to resolve the identity verification issues required to reach our 15 million households’ targets.”

Addressing concerns about the country’s rising debt, Edun noted, “The progress we have made does not diminish the tough realities we still face. Debt service costs remain heavy, consuming a larger-than-ideal share of our revenues. This is the consequence of past borrowing and elevated interest rates.

“At the same time, Nigeria’s fiscal revenue-to-GDP ratio, at about 10 per cent after rebasing, remains one of the lowest in Africa. This limits government resources for essential services like health, education, and infrastructure.”

The minister emphasised that the new Nigeria Tax Act and accompanying legislation, signed into law by the President on June 26, 2025, will help broaden the tax base, simplify compliance, and reduce tax evasion.

According to Edun, the tax reforms introduce a more progressive tax system that protects lower-income earners while adjusting tax rates for those with higher incomes.

“Together with structural revenue reforms such as the Revenue Optimisation and Assurance programme, these measures will strengthen revenues, create fiscal space, and support greater investment in our people and infrastructure.

“A stable economy is crucial, but stability alone is insufficient. To deliver inclusive prosperity, we must anchor growth in sectors that generate jobs and opportunities.

“We are providing necessary incentives to revive investments in the oil and gas industry. With improved security, oil theft is down, and production has rebounded to 1.68 million barrels per day, including condensates. Refinery projects are setting the stage for a stronger downstream sector,” the finance minister highlighted.

Recall that President Tinubu had reaffirmed that during this year’s Independence anniversary speech that his administration’s decision to remove fuel subsidies and unify exchange rates was painful but necessary.

He said those reforms had set Nigeria on a sustainable recovery path, freeing funds for education, healthcare, security, and infrastructure.

Tinubu highlighted that GDP growth reached 4.23 per cent in Q2 2025, the fastest in four years, while inflation dropped to 20.12 per cent, the lowest in three years.

“Dear Nigerians, we are in a race against time. We must construct the roads we need, mend those that are damaged, and build schools for our children and hospitals for our citizens. It is essential that we plan for the generations to come,” the President stated in his Independence Anniversary speech.

Edun reiterated this in his opinion, noting that infrastructure is the backbone of growth.

“Public funds alone cannot meet Nigeria’s vast needs, so we are attracting private capital through public-private partnerships. The Ajaokuta–Kaduna–Kano gas pipeline, and Project Bridge’s 90,000 km fibre expansion are examples of how we are laying out the groundwork for industrialisation and nationwide connectivity.”

He pointed to the renewed interest from local and foreign investors in the country’s economy as signs that the reforms of the Tinubu administration were working.

“Investors – both domestic and foreign, multilateral institutions, and ordinary citizens – are starting to believe in the nation’s prospects again. But confidence is fragile. Sustaining it demands a predictable policy environment, disciplined fiscal management, and steady progress in reducing inflation.

“Our medium-term target is seven per cent growth by 2027/28. Achieving this will require not only government action but the full participation of the private sector, entrepreneurs, and citizens. I am confident that if we work together, we will not only meet this target but surpass it,” he concluded.

punch.ng

FOLLOW US ON: