NIGERIA’S fiscal landscape underwent a seismic shift on June 26, 2025, when President Bola Tinubu signed four landmark Tax Reform Bills into law: the Nigeria Tax Act, Nigeria Tax Administration Act, Nigeria Revenue Service (Establishment) Act, and Joint Revenue Board (Establishment) Act.

Effective 1 January 2026, these laws consolidate more than 70 fragmented taxes into a unified, progressive system administered primarily by the rebranded Nigeria Revenue Service (formerly the FIRS).

The rationale is to simplify compliance, widen the tax base, curb evasion, and boost revenue for development without overburdening the vulnerable.

Yet social media buzz has bred misconceptions, from “all bank transfers are taxed” to “accounts will be confiscated,” which has created panic among some Nigerians, with some already rushing to withdraw their money from banks.

The PUNCH Editorial Board will attempt to cut through the noise, breaking down the impacts on individuals and companies, filing processes, penalties, and why taxes matter.

These laws address Nigeria’s over-reliance on oil, which accounts for 70 per cent of revenue despite volatile prices, according to the NBS data (2024).

By streamlining taxes, eliminating overlaps like the Tertiary Education Tax and IT Levy (now folded into a 4.0 per cent Development Levy), and introducing digital asset taxation, the reforms aim to raise non-oil revenue to 40 per cent of GDP by 2030, per Finance Ministry projections.

Globally, countries depend on taxes to fund services and infrastructure, but Nigeria has relied largely on rent.

For example, Norway, despite its oil wealth, has a top income tax rate of 47 per cent and channels 20-25 per cent of GDP from taxes (not oil alone) into a sovereign fund now worth $1.6 trillion, funding healthcare, education, and infrastructure.

In contrast, Nigeria, with a tax-to-GDP ratio of 13.5 per cent, borrowed N11 trillion in 2025 per DMO, and still failed to implement the capital components of the budget due to revenue shortfalls, mainly oil.

Therefore, Nigeria needs effective taxation to build roads, hospitals, and schools, making tax payment a civic duty, not a burden.

Under the new tax regime, salaried workers, traders, and professionals will be subject to Personal Income Tax that is now progressive. Individuals earning N800,000 or less annually (about N66,000 monthly) are fully exempt, no tax owed.

Above that, rates climb from 15 per cent on N800,001-N3,000,000 to 25 per cent on income over N50 million. This means that those earning the minimum wage of N70,000 or N840,000 per annum will pay 15 per cent tax on N40,000 or N6,000. Someone earning N100 million will pay roughly N24 million.

Taxable income now includes salaries, rents, digital gains from cryptocurrency trading, and interest, which has been broadened to include FX gains and bond premiums.

The previous Consolidated Relief Allowance has been abolished; taxpayers can claim 20 per cent of annual rent paid, capped at N500,000, provided that proof is adduced. Other non-taxable deductions cover pensions, life insurance, and straight-line capital allowances.

Contrary to social media misinterpretations, not all bank transfers are taxed; only unexplained inflows are counted as income after exemptions. It will be helpful if certain inflows, such as gifts or loans, are tagged as such and reported as non-taxable.

Tax ID (TIN) is mandatory as of 2026 for new bank accounts, insurance, or stock trades, linking finance to compliance, but not confiscation.

Businesses now see a tiered Companies Income Tax structure. Small firms with a turnover of less than N100 million annually and assets of less than N250 million will pay zero CIT; they are fully exempt.

Medium-sized firms with a turnover of between N100 million and N1 billion face a 15-20 per cent tax rate, while large companies with a turnover of over N1 billion will pay a 30 per cent tax. Agricultural startups get a five-year holiday.

For individuals, gains from asset disposals (including digital/virtual assets) now form part of their total income and are taxed at the applicable progressive PIT rates, rather than a separate flat rate.

However, share sales in Nigerian companies are exempt if proceeds are less than N150 million annually and gains fall below N10 million, or if proceeds are reinvested locally.

The Nigeria Tax Act 2025 introduces a new 4.0 per cent unified Development Levy on the assessable profits of medium and large companies, effective 1 January. The levy unifies and replaces several existing federal levies, such as the Tertiary Education Tax, NITDA Levy, NASENI Levy, and Police Trust Fund Levy, for simplified compliance.

VAT stays at 7.5 per cent, with essentials such as food, medication, education, and transport now zero-rated. Significantly, businesses can recover input VAT on services and fixed assets, which was previously impossible.

One aspect that also requires clarity is Stamp duty, payable on a wide range of documents executed in Nigeria, such as land and tenancy agreements, deeds of assignment, loan and contract agreements, and share transfers and certificates of occupancy.

This is important as unstamped documents are generally inadmissible as evidence in Nigerian civil court proceedings.

Under the new tax laws (Nigeria Tax Act), the former N50 Electronic Money Transfer Levy has been formally classified as stamp duty, and the sender bears the cost rather than the receiver for transactions of N10,000 and above.

Salary payments and intra-bank transfers between accounts held by the same customer (matching names and BVN/NIN) are exempt from stamp duty.

The new tax laws also prescribe that everyone, exempt or not, must file their tax returns annually with a March 31 deadline for companies, while individuals must file by June 30 via NRS portals.

Taxpayers can self-assess by computing income, subtracting reliefs/exemptions, applying rates, paying, and then filing with audited accounts (for businesses) or income statements. Zero returns for exempt folks prove compliance, but TIN registration is required for tax payment.

What is clear, however, is that NRS has a total view of all banking transactions but cannot legally confiscate bank accounts or impose blanket taxes on deposits.

It is the duty of account holders to report and categorise inflows and claim exemption while filing returns. However, NTAA allows third-party debt recovery only after due process, notices, objections, and appeals.

While cryptocurrency profits are taxed as gains, further valuation guidelines are expected, given the volatile nature of such assets.

The new tax laws impose stricter penalties for non-compliance, which you ignore at your peril.

For example, late filing attracts a N100,000 fine plus N50,000/month of continuous default.

Non-payment of tax attracts a 10 per cent penalty plus interest at CBN’s MPR (currently 27.0 per cent).

Outright tax evasion will be met with criminal charges and or asset seizure post-audit. The NRS can share data across agencies for joint audits to close evasion loopholes.

Despite the six-month time lag between the time the laws were signed and implementation, confusion reigns on X, Facebook and WhatsApp groups, fuelled by fearmongering.

Some trader groups have been meeting, spreading utter falsehoods about the implications of the tax laws, largely due to inadequate sensitisation.

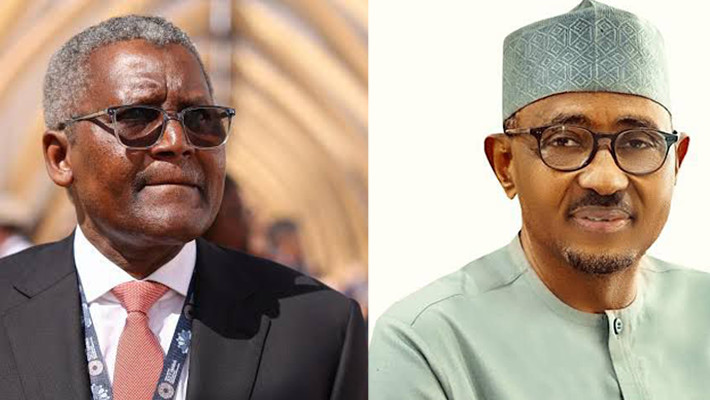

Taiwo Oyedele, Chairman of the Tax Reform Committee, has done most of the talking, but the Ministry of Finance, NRS, Ministry of Information and the National Orientation Agency must do more to educate Nigerians on the new law for complete buy-in and voluntary compliance.

Town halls, radio jingles in pidgin and local languages, NRS apps with simulators, and partnerships with labour unions, market associations, and even religious organisations can help. True, the Tax Ombudsmen can protect rights, but without education, compliance will suffer.

In sum, these reforms lighten the load for the poor and small firms while fairly tapping the wealthy.

Tax payment is not just the citizens’ civic duty; it confers ownership of the government on the people, spurring demands for better accountability from leaders.