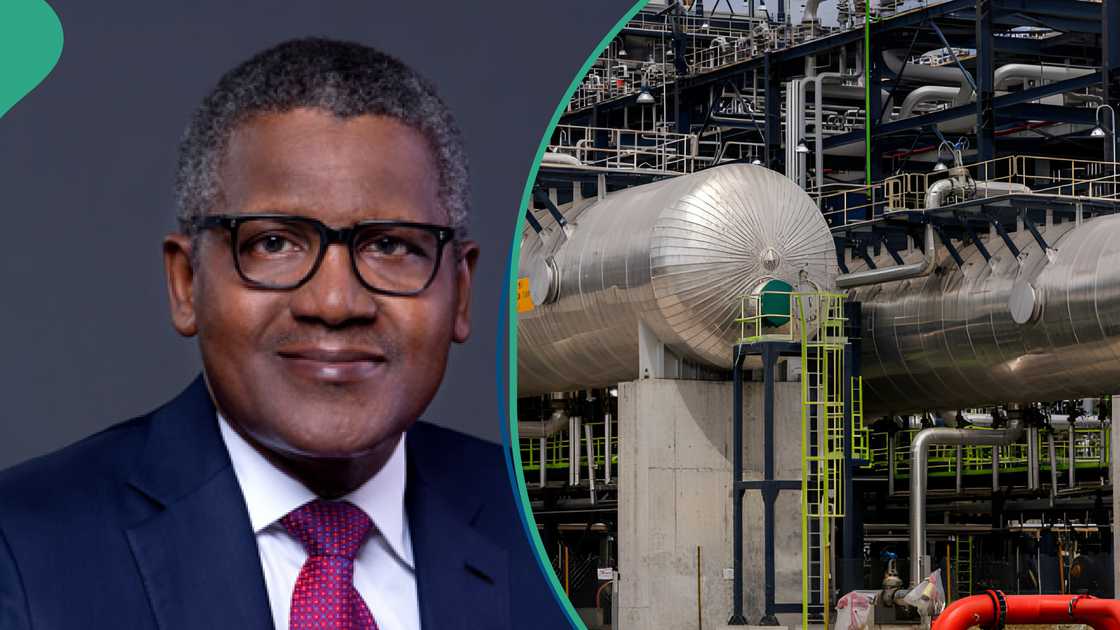

The management of Dangote Petroleum Refinery and Petrochemicals has embarked on a sweeping reorganisation of its operations and workforce.

The refinery said the decision was taken in response to repeated sabotage by staff members that threatened the operational safety of the 650,000 barrels per day facility.

In a letter dated September 24, 2025, and signed by the Chief General Manager, Human Asset Management, Femi Adekunle, the refinery said it was “constrained to carry out a total reorganisation of the plant” following “many recent cases of reported sabotage in different units of the Petroleum Refinery leading to major safety concerns.”

Affected staff were directed to hand over all company property to their line managers and await clearance before receiving their entitlements, which the Finance Department would compute in line with their conditions of service.

However, a senior official of Dangote Petroleum Refinery & Petrochemicals dismissed reports that the company sacked workers en masse, insisting that the recent development was a reorganisation exercise aimed at curbing sabotage within the plant.

Speaking to The PUNCH on Friday, the official, who confirmed the authenticity of the disengagement letter, stressed that its interpretation had been largely misrepresented.

“Yes, the letter is correct. But the interpretation is wrong. The interpretation is that it affects some people because of certain things discovered in the refinery. It has nothing to do with unionism or anything like that,” the official said.

According to him, the move was designed to plug leakages and protect the company’s assets following repeated acts of sabotage.

“It doesn’t mean they have been sacked. That is incorrect. What was done was to put a check in place. It is more like a clean-up in the system to check where those sabotage and leakages are coming from and then address them. As soon as the issues are addressed, they will be reabsorbed. That is why it is not a sack and that word wasn’t used,” he explained.

He added that the exercise was carried out suddenly to prevent those involved in the alleged sabotage from concealing their actions.

“Some acts of sabotage have been noticed repeatedly and the company is only trying to safeguard its assets. Also, you cannot do things like this and give two weeks’ notice; otherwise, those in the act would cover up and complicate issues,” he said.

The official further clarified that refinery operations were ongoing and that both Nigerians and expatriates were still actively working at the plant.

“As we speak, people are still working at the refinery. The people affected know themselves, and those who did not get the letter are not affected. Anyone who doesn’t have a hand in sabotage has nothing to worry about,” he stressed.

When contacted, Dangote spokesperson, Anthony Chiejina, did not respond to messages sent to him by our correspondent

A copy of the disengagement letter, obtained by our correspondent on Friday, was addressed to all staff of Dangote Petroleum Refinery & Petrochemicals FZE and Dangote Industries Free Zone Development Company.

It read, “In view of the many recent cases of reported sabotage in different units of the Petroleum Refinery leading to major safety concerns, the Management is constrained to carry out a total re-organisation of the plant.

“As a consequence of this development, we wish to inform you that your services are no longer required, with effect from the eve of Thursday, the 25th September, 2025.

“Please surrender all the Company’s properties in your possession to your line manager and obtain an exit clearance accordingly, but the date for doing so will be communicated to you later.

“The Finance Department, by a copy of this letter, is advised to compute all your benefits and entitlements in line with your terms of employment and conditions of service and pay the amount due to you (less all indebtedness), subject to the condition that you have obtained the exit clearance certificate as mentioned above.

“We seize this opportunity to thank you for your services while you were in our employment.”

The refinery, which commenced production in 2024 amid fanfare and expectations of ending Nigeria’s decades-long reliance on imported petroleum products, is already battling operational turbulence and industrial disputes.

Recently, the refinery was enmeshed in a bitter row with the Nigeria Union of Petroleum and Natural Gas Workers over labour practices and safety standards.

The oil workers’ union had accused the company of “high-handedness” and warned against what it described as an emerging pattern of unfair labour practices.

The plant also faced friction with the Depot and Petroleum Products Marketers Association of Nigeria over product pricing and distribution arrangements, with marketers alleging that Dangote imposed rigid conditions that could distort the downstream market.

punch.ng

FOLLOW US ON:

FACEBOOK

TWITTER

PINTEREST

TIKTOK

YOUTUBE

LINKEDIN

TUMBLR

INSTAGRAM