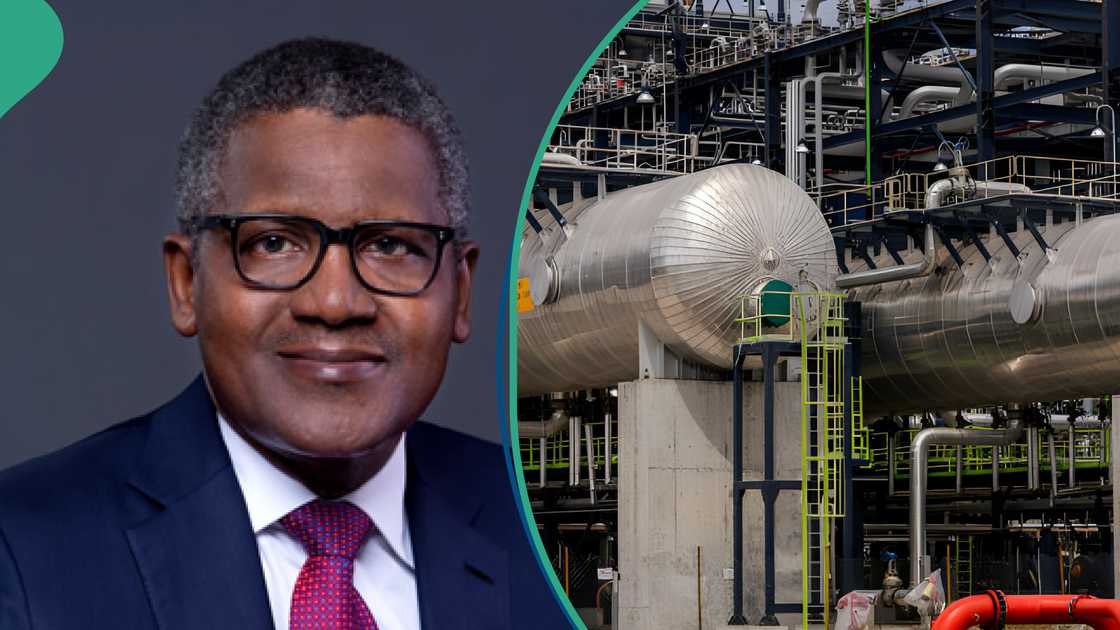

Officials of the the Dangote Petroleum Refinery have said that the plant pumped 43.3 million litres of Premium Motor Spirit (petrol) into the Nigerian market on Saturday.

They exclusively disclosed this to our correspondent, debunking claims that the refinery had shut down its petrol processing unit for maintenance.

The officials, who preferred not to be named due to a lack of authorisation to speak on the matter, explained that some marketers were only looking for excuses to increase petrol gantry prices, which the refinery crashed from N828 to N699 per litre.

Over the weekend, there were reports that some depots raised petrol prices above N800 per litre, on claims that the Dangote refinery had shut its petrol unit.

But an official of the $20bn plant queried the plan by depot operators to increase petrol prices.

Asked if the refinery had been undergoing a maintenance downtime that could trigger a price hike, the source replied, “False! Have we stopped loading or turned back a single truck that has come to load? Yesterday (Saturday) alone, we loaded 43.30 million litres of PMS.”

The source said this was “about 50 per cent more than the actual daily (petrol) consumption of Nigeria”.

Another official told The PUNCH that the company has enough fuel in its tanks to serve the country for the next 20 days, saying this was to allay any fear of supply disruptions or fuel scarcity. “We have a stock which is more than 20 days of Nigerian consumption,” the source stated.

The official expressed concerns that some traders were hiking prices to create tension in the sector, urging Nigerians to patronise filling stations selling Dangote products. “The public should go only to filling stations where our products are sold. They will get whatever they require there,” he stated.

The PUNCH reports that private depots across Lagos and other key fuel trading hubs have increased the ex-depot price of PMS to as high as N800 per litre over the claim that Dangote had shut down its petrol unit.

According to petroleumprice.ng on Saturday, the average cost of petrol at private depots increased within 48 hours, creating concerns over a possible spike in retail pump prices. While the Dangote refinery said it sells petrol at N699 per litre, other depot prices jumped above N800.

Eterna and Integrated depots raised petrol prices to N800 per litre on Friday, compared with N726 per litre at Shellplux and AIPEC earlier in the week, indicating a jump of N74 per litre within two days. Similarly, Aiteo and Lister depots sold petrol at N780 per litre, up from the N750–N760 band recorded on Wednesday.

The impact was more pronounced in Warri, one of the country’s key petroleum logistics hubs. While Matrix Energy and other major depots sold petrol at N800 per litre on Wednesday, prices climbed to as high as N805 per litre by Friday, according to the report.

Marketers were said to have linked the price surge to a “shutdown of the petrol unit at the Dangote refinery”, which is currently a major domestic supplier of PMS, helping to moderate prices following the removal of fuel subsidies.

In December, the Dangote refinery reduced its petrol gantry price from N828 to N699 per litre. The refinery shocked depot owners and marketers when it slashed the gantry price of petrol by N129, causing them to incur losses running into billions of naira.

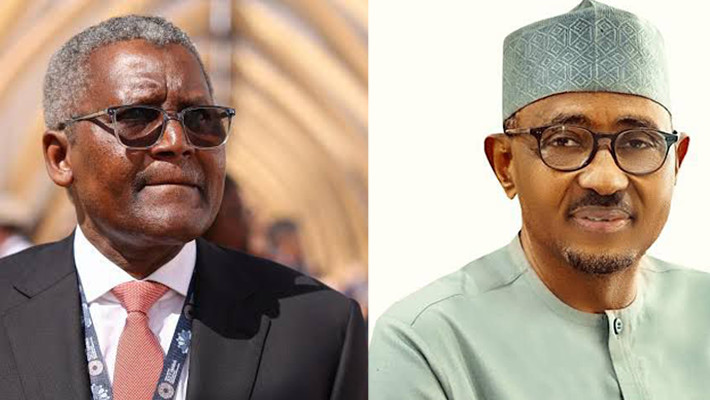

During a briefing, the President of the Dangote Group, Aliko Dangote, vowed to enforce the new price regime, with MRS selling petrol at N739 nationwide.

The PUNCH reports that as more MRS filling stations in Lagos and Ogun states joined in dispensing petrol produced by the Dangote Petroleum Refinery at N739 per litre, motorists started boycotting retail outlets that sold the product at higher prices.

This compelled other stations to lower their petrol prices, selling at an amount that is far below their cost of purchase.

Meanwhile, as marketers said they were losing billions of naira, Dangote replied that he was also losing money. Findings by The PUNCH showed that petrol importers might lose as much as N102.48bn monthly following the Dangote refinery’s reduction in gantry price.

At the same time, the refinery is projected to lose about N91bn in a month as a direct consequence of the price cut. But Aliko Dangote said he would prefer losing money to allowing petrol imports to thrive.

Analysts noted that the price uptick is a deliberate move by importers to make up for the losses suffered when Dangote slashed petrol prices. However, this may not be achieved, as the refinery ruled out any imminent supply disruptions.