With more than 30 years of experience across financial journalism, capital market operations, education, and strategic communications, Sola Oni stands as a prominent figure in Nigeria’s investment landscape. A former spokesperson for the Nigerian Stock Exchange (now NGX) and a Fellow of both the Chartered Institute of Stockbrokers and the Institute of Capital Market Registrars, Oni discusses with OLUWAKEMI ABIMBOLA the importance of minority investors in market growth and other emerging developments in Nigeria’s financial sector

The capital market has witnessed several developments recently, from the transition to a T+2 settlement cycle to the recognition of digital assets such as cryptocurrency. How do you assess these changes and their implications for the market and the wider economy?

The commencement of the Central Securities Clearing System operations on 14 April 1997, established a central depository with an electronic clearing and settlement system. It began with T+5 (Transaction Day plus five working days). In 2000, CSCS advanced to T+3, the settlement cycle it has maintained to date.

Before this milestone, the Nigerian capital market relied on a manual clearing and settlement system, which was entirely paper-based. Investors were issued physical share certificates as proof of ownership, a process fraught with numerous challenges. Clearing and settlement could take weeks or even months due to manual document verification. Registrars were required to authenticate share certificates, which were physically delivered for ownership transfer and register updates.

The manual process was susceptible to theft, administrative bottlenecks, high transaction costs, reconciliation errors, fraud, and forgery. As a dynamic institution, CSCS is now set to launch a T+2 clearing and settlement cycle on 28 November. All stakeholders are prepared for this historic event, which will be inaugurated by the Securities and Exchange Commission.

The ultimate goal is to achieve T+1, which is already the standard in several advanced markets. This means that if you buy or sell securities today, payment and ownership transfer will be completed the following day. Markets such as the Toronto Stock Exchange in Canada, Bolsa Mexicana de Valores in Mexico, NSE and BSE in India, and the Shanghai and Shenzhen Stock Exchanges in China already operate this benchmark.

Let me add that T+0 is uncommon, as it requires real-time cash and securities availability. It can reduce liquidity since funds and securities are tied up immediately. Although a few markets, including China, the United States, and India, operate T+0, it is mostly limited to digital assets and certain money market instruments.

Many companies in the financial services sector are currently undergoing recapitalisation. How should minority investors position themselves to take advantage of this trend?

Minority investors, those owning less than 50 per cent of a company, are essential to every thriving capital market. Regardless of ownership size, every investor must begin with the basics: What is my investment objective? What is my risk tolerance? What is my time horizon? And what is my source of funds?

An investor who cannot answer these questions is simply taking uncalculated risks, which often end badly. As the financial services sector evolves, minority investors need to be strategic. A good starting point is understanding the investment policy of the target company and identifying growth segments with strong potential. These include undercapitalised mid-tier banks, emerging fintech firms, and high-performing insurance companies.

A minority investor’s objective should align closely with that of the target company. It is also prudent to focus on firms where recapitalisation can unlock regulatory reliefs, improve credit ratings, and strengthen growth capacity. Positioning in such companies enhances returns and provides a pathway to sustainable wealth creation. In a reform-driven and innovative market, the best opportunities often lie where growth and regulation converge in favour of investors.

Tax reforms are expected to take effect next year. What impact might these have on the capital market?

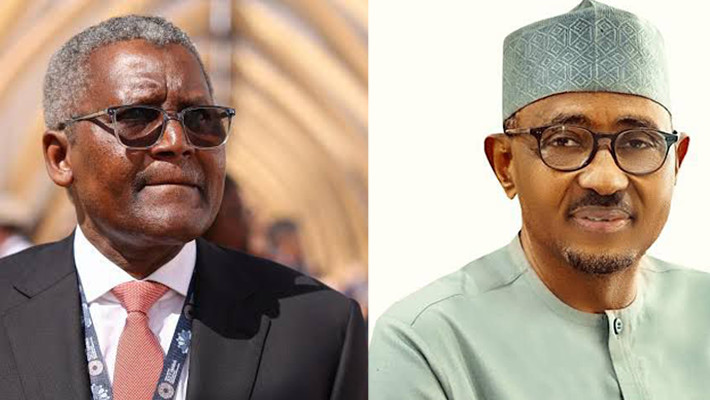

The ongoing work of the Presidential Committee on Tax and Fiscal Policy Reforms, chaired by Mr Taiwo Oyedele, is generating significant interest across Nigeria’s economic landscape. Stakeholders believe that the committee’s recommendations will have far-reaching implications for businesses, investors, and the capital market as a whole.

In the capital market, taxation is a major determinant of competitiveness. It affects corporate earnings and, by extension, shareholder returns. For foreign investors, tax policy is often a critical factor in assessing a country’s investment appeal. Key taxes that directly affect investors include Capital Gains Tax, Withholding Tax on dividends, Transaction Taxes, and Stamp Duties.

However, there are growing concerns among market participants over the proposed increase in Capital Gains Tax from 10 per cent to 30 per cent, which could discourage high-net-worth individuals, institutional investors, and foreign portfolio investors. Analysts warn that such an increase might weaken market confidence and reduce overall investment inflows.

The capital market community therefore looks to the government to consider tax incentives and relief measures that can enhance Nigeria’s global competitiveness. Stakeholders continue to engage with Mr Oyedele and his team, seeking assurance that the reforms will foster growth while preserving investor confidence. Mr Oyedele has repeatedly emphasised that the reforms aim to promote fairness, transparency, and alignment with global best practices.

As the committee’s work progresses, we in the capital market are optimistic that the outcome will have a net positive impact, boosting investor sentiment and positioning Nigeria’s capital market for sustainable growth.

How would you assess Nigeria’s progress in developing a commodities exchange ecosystem?

Nigeria’s commodities exchange ecosystem is still largely untapped but brimming with potential. Encouragingly, awareness of the benefits of commodities exchanges is growing, driven primarily by private-sector-led initiatives.

For instance, in September, the Lagos Commodities and Futures Exchange listed N23.4bn worth of Eko Rice Classic Spot Contracts, a milestone in transforming Nigeria’s agricultural and commodities sectors.

One major source of optimism is the new Investment and Securities Act (2025), which has addressed previous policy gaps and formalised the country’s commodities ecosystem. The Act has strong potential to stimulate economic growth if effectively implemented.

Nonetheless, stronger regulatory support is needed. The government should consider making it mandatory for commodity producers and exporters to use exchange platforms. This would have a multiplier effect on GDP growth and boost foreign exchange earnings. It should also create an enabling environment for private-led commodities exchanges by supporting warehousing and logistics infrastructure to reduce post-harvest losses and enhance token and receipt delivery.

With the number of minority investors on the rise, how crucial is investor education in sustaining market growth and promoting economic resilience?

Minority investors, those owning less than 50 per cent of a company’s shares, are key stakeholders in Nigeria’s capital market. Their protection and active participation are vital for building investor confidence and ensuring fair corporate governance.

Under the Companies and Allied Matters Act 2020, SEC rules, and NGX listing requirements, minority investors are entitled to several rights that protect their interests and promote accountability.

They have the right to information, ensuring access to periodic financial statements, annual reports, and corporate disclosures, as well as rights to dividends, entry and exit, and protection from oppressive conduct by majority shareholders or directors. They can attend and vote at annual and extraordinary general meetings and participate in rights issues and bonus share offers, thereby preventing unfair dilution of their holdings. In cases of dispute, they can seek legal redress, including court petitions under CAMA for oppression, mismanagement, or unfair prejudice.

These provisions reflect the joint efforts of the SEC, NGX, and the Corporate Affairs Commission to promote transparency and investor protection. When listed companies respect these rights, they strengthen corporate reputation, improve liquidity, and attract both domestic and foreign investors.

Beyond rights, minority investors serve as critical checks and balances on boards and management. Through constructive engagement, asking questions, demanding accountability, and scrutinising decisions, they help uphold governance standards. Their participation in public offers, rights issues, and private placements also deepens liquidity and supports capital formation, which ultimately strengthens the economy.

Protecting minority investors is therefore not merely a legal duty but a strategic necessity for market growth.

A transparent, equitable system that safeguards all investors will enhance confidence and position Nigeria’s capital market as a globally competitive investment destination.

How do you envision Nigeria’s capital market evolving over the next five years?

Capital market development is a marathon, not a sprint. Over the next five years, I envision a market shaped by technology, innovation, and broader participation, particularly from millennials, Gen Z, and other digital natives.

The rise of digital platforms and the introduction of innovative investment products are likely to attract tech-savvy investors, expanding market reach and liquidity. More companies are expected to tap into the capital market for long-term funding, while the government may increasingly rely on market instruments to finance infrastructure projects.

With the CSCS set to commence T+2 settlement this month, the market will become more efficient and competitive in transaction processing.

We can also anticipate significant growth in the commodities ecosystem, with private-sector-led exchanges contributing to GDP expansion and boosting the global competitiveness of Nigerian agricultural products. The Over-the-Counter Exchange, led by NASD Plc, is also poised for increased activity as new products and strategies attract retail and institutional investors.

However, these projections depend on key factors such as the faithful execution of economic reforms, adoption of emerging technologies, and full implementation of the SEC’s Capital Market Master Plan and ISA 2025. With these in place, Nigeria’s capital market could evolve into a more inclusive, innovative, and globally competitive environment.

You began your career in journalism before transitioning into capital market operations and corporate communications. How did that journey unfold?

My transition into the capital market began in 1992 when my editor at The Guardian, Mr Jide Ogundele, sent me to the library to study the Financial Times of London for two days. Until then, I had covered multiple beats, Energy, Money Market, Aviation, Insurance, and Manufacturing, often producing front-page news.

At The Guardian, excellence was non-negotiable. Readers were largely middle-class and above, so one had to be exceptional in both reporting and writing to keep the job.

My first visit to the Nigerian Stock Exchange (now NGX) in 1992 was fascinating. Journalists watched from the gallery as stockbrokers shouted bids and offers on the trading floor, a system known as the Call-Over or Open Outcry. It was a vibrant, disciplined environment where trading, price discovery, and share allocation were meticulously coordinated.

After each session, journalists compared the Exchange’s Daily Official List with their records to ensure accuracy. Our reports influenced broker decisions, sparked debate, and even moved share prices, a reflection of how much the market depended on credible reporting.

Although the Call-Over System was engaging, it was also time-consuming and dependent on the Chairman’s discretion. Covering the capital market was demanding because it required understanding the broader economy, how macroeconomic variables influenced company performance and stock prices.

In 1994, I was briefly de-accredited by The Exchange, but The Guardian stood by me. By 1997, I joined The Exchange itself, and that same year, I won the Diamond Award for Excellence in Financial Reporting. I rose to management level, led a department, and contributed significantly to the organisation’s growth.

The Exchange invested in my training, I studied at the New York Institute of Finance, trained at the U.S. SEC’s International Institute for Securities Market Development in Washington D.C., and interned at the World Bank in Chicago.

Today, I am a Fellow of both the Institute of Capital Market Registrars and the Chartered Institute of Stockbrokers, as well as a member of the Commodities Brokers Association of Nigeria and the Chartered Institute for Securities and Investment, UK.

I currently work as a public relations consultant, integrated communications strategist, and educationist, maintaining strong ties to the capital market. Journalism laid the foundation for my understanding of finance, governance, and market dynamics, skills that have shaped my entire professional journey.

If you could advise regulators and listed companies on one mindset shift, what would it be?

Both the apex regulator (SEC) and self-regulatory organisations play a crucial role in enforcing market rules and protecting investors. With rapid technological change, regulatory frameworks must evolve accordingly.

The Investment and Securities Act should be reviewed periodically to ensure that regulators stay ahead of market operators, addressing potential infractions before they escalate. Likewise, listed companies must strictly comply with post-listing requirements to maintain transparency and investor trust.

Ultimately, market growth depends on trust. Regulators and operators share responsibility for building and maintaining this trust. Regulators must enforce rules consistently, while operators, brokers, listed firms, and other participants, must act with integrity and provide accurate, timely information.

When investors are confident that the market is fair, transparent, and responsive, they are more willing to commit capital, which in turn fuels liquidity, growth, and long-term stability.

Looking back, what achievement are you most proud of in your capital market journey?

I have consistently advocated for policy reforms, highlighted structural and fiscal challenges, and promoted greater participation in the capital market through my writings and public commentary.

I am also passionate about mentoring the next generation of financial journalists, helping them to embrace accuracy, integrity, and professionalism. Through these efforts, I aim to encourage informed investing, strengthen governance, and contribute to building a more inclusive and resilient market ecosystem.

punch.ng

FOLLOW US ON: