Average hotel room rates in Lagos have climbed to a record N205,534, a sign of how quickly business and corporate travel is returning to Nigeria’s commercial capital, even as new hotel supply lags. Data from Estate Intel’s Lagos Real Estate Development Pipeline Report 2025/2026 shows demand rebounding faster than the city’s ability to add rooms.

The report showed average daily rates more than doubled from N83,105 in 2023 to N205,534 by October 2025, the highest level on record. The research firm said the increase was driven by renewed corporate activity, improved connectivity to key business districts, and delays in delivering new high-quality hotel projects following years of construction setbacks.

The document noted that Lagos’ hospitality performance highlights how quickly demand has recovered relative to supply, particularly in prime business locations.

“Average daily rates in Lagos are currently as high as they have ever been, supported by business and corporate travel and constrained supply following several years of delayed hotel deliveries,” the report stated.

Hotel occupancy in the over 20 million population state stood at 66.7 per cent as of October 2025, according to data cited in the report, with expectations that occupancy will stabilise in the high-60 per cent to low-70 per cent range over the coming years.

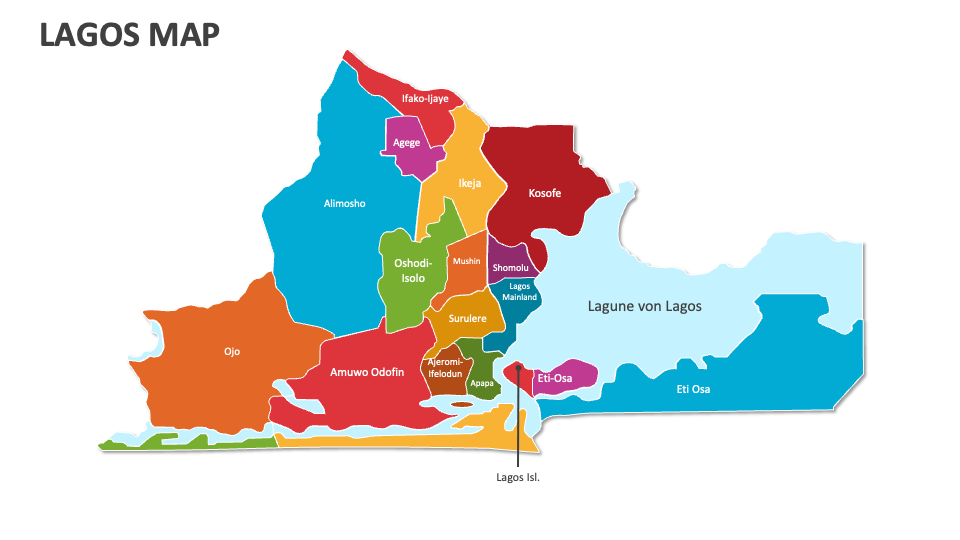

The city’s hospitality demand continues to be anchored by business travel, supported by proximity to the international airport and improved accessibility across major commercial hubs such as Victoria Island, Ikoyi, and Ikeja.

While leisure travel remains a smaller component of demand, the steady return of conferences, corporate meetings, and regional business travel has helped sustain both occupancy and pricing power for hotel operators.

Lagos currently has an estimated 10,728 hotel keys, with an additional 3,709 keys in the development pipeline, making it the largest hospitality pipeline market in West Africa by volume. However, the report indicated that more than one-third of planned hotel projects are on hold, reflecting lingering challenges such as high construction costs, foreign exchange volatility, and cautious capital deployment.

As a result, the pace of new hotel completions has lagged earlier projections, helping to keep the market broadly balanced despite rising demand.

“An uncertain business environment in recent years has limited the delivery of new hotel stock and pushed completion dates further out,” Estate Intel said. “This has supported pricing as demand has returned faster than supply.”

Major branded projects in the pipeline include developments under global hotel chains, though only a limited number are expected to reach completion in the short term.

The report also highlights growing competition between traditional hotels and the expanding short-let apartment market, particularly in prime districts. The influx of short-let units has increased supply options for travellers and corporates, putting pressure on some operators.

Anecdotal evidence from December suggests mixed performance across short lets, with some operators reporting weaker occupancy while others continue to see steady demand. Despite this competition, traditional hotels have largely maintained strong performance due to their focus on corporate clients and branded service offerings.

Broader economic backdrop

The rebound in hotel rates comes amid improving macroeconomic conditions. Capital importation into Nigeria rose to $7.3bn in 2024, the highest level in three years, while inflation has shown signs of stabilisation following the rebasing of the consumer price index. The International Monetary Fund revised Nigeria’s 2025 GDP growth forecast upward to 3.9 per cent, supporting expectations of continued economic recovery.

Following the rebasing of GDP data, real estate services now contribute 13.36 per cent of Nigeria’s GDP, underscoring the sector’s growing importance to the economy and reinforcing investor interest in hospitality and other property assets.

Estate Intel said the outlook for Lagos’ hospitality market remains positive, with limited near-term supply expected to keep the sector balanced even as demand improves.

“We anticipate a more bullish environment for hotels as the economy continues to recover, particularly given the limited delivery of high-quality stock over the next few years,” the report said.

While operators may face increasing competition from short-let accommodation and rising operating costs, the firm expects Lagos’ role as Nigeria’s commercial capital to continue underpinning hotel demand, keeping room rates elevated in the medium term.

FOLLOW US ON: