Procurement delays, worsening insecurity, and rising costs of goods and services have emerged as major reasons several state governments failed to meet their capital expenditure targets in the first six months of 2025.

Findings from states’ second-quarter Budget Implementation Reports revealed that capital spending across many states remained significantly below expectations, despite ambitious budgetary provisions designed to accelerate infrastructure growth.

A fresh breakdown of state government expenditure between January and June 2025 showed that 31 states collectively disbursed N2.75tn for capital projects.

However, this figure represents only a fraction of the N17.51tn they had budgeted for capital expenditure in the 2025 fiscal year.

The budget performance of those figures is about 15.7 per cent, meaning the 31 states achieved less than one-fifth of their capital expenditure target in the first half of 2025.

The underperformance has delayed critical infrastructure projects and deepened hardship for citizens who rely on improved roads, schools, hospitals, and water systems.

This is also coming on the heels of the fact that the states earmarked N11.34tn to finance capital projects but eventually recorded a funding gap of N3.98tn in 2024, as revenue shortfalls, rising wage bills, and heavy debt servicing weakened their fiscal capacity.

This year’s half-year performance suggests that the same structural challenges remain unresolved.

According to experts, capital spending is the fund disbursed by the state on long-term investments aimed at improving infrastructure, services, or the economy.

These expenditures are typically used for projects that have a lasting benefit, such as building roads, bridges, schools, hospitals, public transport systems, and other essential infrastructure to foster economic growth, improve quality of life, and ensure better public services for citizens.

The clamour for improved infrastructure has grown louder in the aftermath of the fuel subsidy removal and foreign exchange devaluation, which have significantly boosted revenue inflows to the federal, state, and local governments, raising public expectations for visible development outcomes.

Last month, President Bola Tinubu urged state governors to prioritise Nigerians’ welfare by investing more in their future, putting more money into rural electrification, agricultural mechanisation, poverty eradication, and improved infrastructure investment.

Tinubu implored the governors to do more to positively impact the lives of Nigerians in the grassroots, saying, “I want to appeal to you; let us change the story of our people in the rural areas.

“The economy is working. We are on the path of recovery, but we need to stimulate growth in the rural areas. We know the situation in the rural areas, let us collaborate and do what will benefit the people,” he added.

President Tinubu urged state governors to collaborate with the Federal Government to drive economic development in rural areas nationwide. “We have to embrace mechanisation in agriculture, fight insecurity, and improve school enrolment through feeding,” the President said.

Despite the revenue windfall, many states have failed to meet their mandate of delivering key infrastructure for citizens, with governors attributing the shortfall to persistent insecurity, cumbersome procurement processes, and other long-standing challenges.

An analysis of the fiscal performance of each state, utilising data from the Q1 to Q2 budget performance reports obtained from each state’s website, revealed the scale of the challenges.

The breakdown showed sharp contrasts in budget performance across the country, with 31 states collectively spending N2.75tn on capital projects and N2.35tn on recurrent expenditure between January and June 2025.

An analysis of states’ second-quarter Budget Implementation Reports revealed that while some states channelled the bulk of their resources into infrastructure and development projects, others leaned heavily on recurrent costs such as salaries, allowances, and overheads.

Enugu State recorded the highest capital-to-recurrent ratio, with 81.9 per cent of its total expenditure (N99.59bn) going into capital projects, compared to N22.06bn for recuThe 27.1 per cent performance is indeed), Bayelsa (69 per cent), and Kebbi (68 per cent) followed closely, ranking among the most capital-focused states in the first half of the year.

Imo State led the pack on infrastructure development with N188.1bn channelled into capital expenditure, compared to just N50.29bn on recurrent. Enugu followed closely, committing N99.59bn to capital projects against N22.06bn for recurrent, making it the most capital-focused state in terms of percentage allocation.

Bayelsa also posted a strong capital bias, spending N238.29bn on capital against N107.26bn recurrent, while Abia disbursed N133.1bn on capital compared to N39.73bn recurrent. Edo and Akwa Ibom both crossed the N170bn mark in capital expenditure, allocating N179.56bn and N179.76bn respectively.

Other states that leaned more towards capital included Borno (N92.99bn vs N61.59bn recurrent), Gombe (N93.99bn vs N52.25bn), Jigawa (N82.99bn vs N56.63bn), Kebbi (N78.86bn vs N36.81bn) and Zamfara (N51.1bn vs N37.57bn).

At the other extreme, several states recorded higher recurrent spending than capital, raising concerns about long-term development priorities. Kogi was the most recurrent-heavy, spending N133.22bn on recurrent compared to N73.16bn on capital.

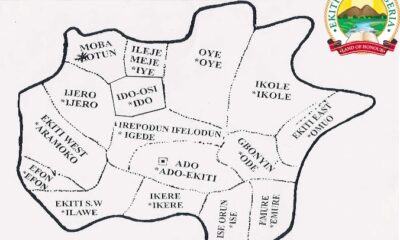

Ekiti followed, with N101.1bn on recurrent against N56.1bn capital, while Osun allocated N89.37bn to recurrent and only N57.13bn to capital. Oyo also tilted towards consumption, disbursing N129.06bn recurrent against N110.64bn for capital projects.

Ogun balanced closely, spending N157.15bn on recurrent and N155.64bn on capital. Similarly, Bauchi (N97.29bn recurrent vs N91.69bn capital), Kano (N115.24bn recurrent vs N90.79bn capital), Kwara (N71.59bn recurrent vs N62.68bn capital), Nasarawa (N68.3bn recurrent vs N48.49bn capital), Ondo (N84.37bn recurrent vs N61.88bn capital), Sokoto (N72.18bn recurrent vs N69.01bn capital) and Taraba (N57.88bn recurrent vs N24.17bn capital) all leaned more towards recurrent expenditure.

A few states maintained near parity between the two categories. Kaduna disbursed N108.45bn on capital and N100.31bn recurrent, while Ebonyi’s spending was almost evenly split at N36.89bn capital and N38.38bn recurrent.

The overall capital share of 53.9 per cent across the 31 states indicates that subnationals are still devoting nearly half of their budgets to recurrent obligations, despite revenue windfalls from subsidy removal and foreign exchange reforms.

The poor performance has tangible effects. In Benue, where only N23.32bn was spent on capital projects compared to N44.5bn on recurrent, key roads and agricultural projects have stalled due to insecurity. Similarly, Cross River allocated just N30.53bn for capital against N84.8bn for recurrent, limiting its capacity to address infrastructural deficits in education and healthcare.

Commenting on this, Governor Hyacinth Alia of Benue State blamed the state’s poor performance on widespread insecurity.

“The poor recorded performance is largely due to the overwhelming insecurity challenges faced by the state during this reporting period,” the budget report said.

In June, no fewer than 200 people were killed when gunmen attacked Yelwata community in Guma Local Government Area of Benue State.

Although the state raised its 2025 capital budget by over N100bn to stimulate “aggressive urban and rural infrastructural development,” authorities admitted that implementation, particularly in the second quarter, “was significantly slowed down” as contractors were unable to mobilise.

Jigawa State also struggled, with officials describing capital performance as “below average.”

According to the report, “Procurement plans of most capital-intensive projects of most MDAs primarily target beyond the first quarter, which are to ensure providing adequate time to deal with all the necessary contract procedures. During the second quarter, many of these projects entered the implementation phase, with several undergoing tender approvals and vetting processes.”

The government, however, expressed optimism that performance “will improve significantly by the third quarter.”

Imo State reported capital expenditure performance of just 27.1 per cent as against the expected 50 per cent by mid-year.

“The 27.1 per cent performance is indeed much less than expected, however capital expenditure does not strictly follow that format of equally splitting the total amount across the four quarters,” the government said.

It cited recent funding gap analysis in primary education and health that slowed releases, coupled with insurgency in parts of the state.

“The current spate of insurgency in and around the state has also affected the mobilisation of contractors whose procurement processes have been completed to commence work,” the report noted.

Borno State attributed its weak capital performance to “low capital inflows from budgeted sources and other peculiarities of the state.”

The government disclosed that an amendment was made in the revised 2025 budget “to cater for overspending on both recurrent and capital expenditure in Q1 and Q2.”

In Ebonyi, officials said capital budget utilisation stood at just 11.3 per cent.

“The relatively low performance is primarily attributed to the budget profiling approach, which scheduled the implementation of several large-scale capital projects for the third quarter and beyond,” the report stated.

Authorities added that some expenditures in health and education were not captured in the approved budget.

“To address these issues, the state plans to undertake a budget review in the third quarter to incorporate these expenditures and realign budget provisions to support timely and efficient project execution,” the report added.

In Sokoto State, capital performance stood at 19.7 per cent as of Q2, which government admitted was “below expectations.”

“This is largely due to the procurement process attached to capital projects that takes time as well as slow performance on the part of some contractors,” the budget report said.

They added that the government had set up a Projects Monitoring Committee “to change the trend in subsequent quarters.”

Yobe blamed delays in approvals and soaring costs for its underwhelming execution.

“Delays in the commencement of certain key projects, particularly those that required memo approvals, were primarily due to bureaucratic bottlenecks,” the report stated.

The government, however, noted progress in road, market and flyover projects, but said external factors hurt delivery timelines.

“The rainy season and the general rising costs of goods and services significantly impacted the timelines for project execution,” it said.

Governor Abdullahi Sule of Nasarawa State pointed to front-loading difficulties typical of large infrastructure projects.

“This slow pace reflects the challenge common in infrastructure projects, where initial disbursements are slower as project planning, procurement, and mobilisation processes are finalised,” the government explained.

It admitted overspending in certain areas such as “purchase of motor vehicles, rehabilitation of equipment, and anniversaries/celebrations,” but pledged to correct this in its budget review.

Zamfara said its low capital performance was mainly because “many capital projects were still undergoing procurement processes.”

“Payments for mobilisations commenced in the second quarter, while disbursements for ongoing projects will mainly occur in the third quarter after achieving significant milestones,” the government noted.

In Kebbi State, officials blamed the decline in capital spending on the “gradual re-evaluation of all capital projects to ensure proper procurement practices are followed.”

The government also prioritised the payment of outstanding contract arrears.

“The State Government continues to prioritise major infrastructural projects while ensuring a keen focus on education, health and other social sectors,” the report said, adding that MDAs have been urged to “intensify fund requests for completion of projects.”

Adamawa reported capital expenditure of N52.4bn out of a N348.9bn allocation, representing just 15 per cent performance.

“While this performance may appear low, the state is making efforts to improve investment in long-term projects,” the government explained.

Across the board, state governments blamed insecurity, procurement delays, bureaucracy, weak capital inflows, and high project costs for their poor performance. While most expressed optimism that execution will improve in the third quarter, analysts warn that persistent underperformance in capital expenditure could stall infrastructure delivery and economic growth at the subnational level.

A Professor of Economics at Babcock University, Segun Ajibola, stated that the enduring problem of high governance expenses had persisted at the state level, with inadequate oversight and accountability resulting in minimal economic benefits for grassroots citizens.

Meanwhile, Nigeria’s 31 states spent a combined N2.36tn on recurrent expenditure between January and June 2025, surpassing by 18.3 per cent or N364bn, the N1.994tn governors personally racked up on refreshments, sitting allowances, travel and utilities in the first nine months of 2024.

A breakdown of the states’ recurrent bills, obtained from official budget performance reports, shows that Ogun (N157.15bn), Kogi (N133.22bn), Oyo (N129.06bn), Kano (N115.24bn) and Akwa Ibom (N113.44bn) topped the chart as the biggest recurrent spenders in the first half of this year.

On the other hand, Enugu (N22.06bn), Katsina (N26.39bn), Zamfara (N37.57bn), Ebonyi (N38.38bn) and Abia (N39.73bn) reported the lowest recurrent allocations in the period.

FOLLOW US ON:

FACEBOOK

TWITTER

PINTEREST

TIKTOK

YOUTUBE

LINKEDIN

TUMBLR

INSTAGRAM