Mr President, Nigerians have walked with you through a season of fire. They have endured subsidy removal, foreign exchange shocks, inflation that eats wages before payday, and reforms that have stretched household budgets to their breaking point. They did so because you asked for time — time to rebuild, to reform, to restore.

Now, after this difficult year of sacrifice, the government has confirmed that it will introduce a 15 per cent import duty on petrol and diesel. Mr President, this decision risks turning faith into fatigue. It is not reform, it is relapse — and it could undo the fragile trust Nigerians have placed in your leadership.

According to the leaked memorandum from the State House dated October 10, 2025, the new tariff is framed as a “market-responsive import framework” meant to “safeguard local refining capacity and stabilise the downstream market”. But Nigerians are not fooled by the language of protection when its result is punishment.

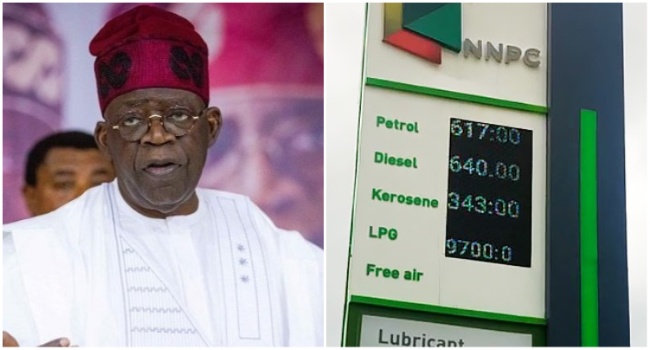

This tariff, applied to the cost, insurance, and freight value of imported fuel, will raise the landing cost of petrol by roughly N150–N175 per litre. That means the average pump price could surge toward N970 or more per litre, a direct hit to every household, every transport operator, every food vendor, every generator owner.

This policy claims to “protect local refineries”, but the reality is different: it protects one refinery, the Dangote Refinery, at the expense of an entire nation. The refinery, which currently supplies only about 22 million litres daily, cannot meet Nigeria’s 50 million-litre daily consumption. So, the rest will still come from imports — but now, imports that must bear a punitive 15 per cent tax, ensuring Dangote’s petrol looks cheaper, even when it isn’t.

That is not protectionism; it is manipulation dressed as policy.

Inside that closed circle lies the new “fuel cabal”, a collection of powerful businessmen who have aligned themselves with the refinery to dictate who lifts petrol, who gets access, and at what price. The market, which deregulation was meant to free, is now being redesigned for control.

We are told this tariff will “stabilise the market.” But, as history teaches us, monopolies do not stabilise; they suffocate. In cement, sugar, and now fuel, the pattern remains the same: establish dominance, then block rivals through state-backed regulations. What we are witnessing is not industrial policy — it is industrial capture.

Every naira added to fuel prices ripples across the economy. Transport fares rise by 20–30 per cent. Food prices follow. Inflation deepens. The middle class shrinks further. The poor lose what little dignity inflation has not already taken. And all this, in the name of protecting an investor who built a “state-of-the-art” refinery but cannot yet supply half the country’s needs.

Economic policy is not a courtroom for the powerful to plead for privilege. It is a covenant between the government and the people. And that covenant is broken when policy tilts toward a single enterprise.

When global oil markets faced deregulation, from the United States to South Korea, competition — not tariffs — built resilience. Local refiners had to innovate, not lobby for protection. In the 1980s, American refiners survived the global glut not because of tariffs, but because the market forced them to be efficient, invest, and adapt. South Korea’s chaebols, initially sheltered, became efficient only after the state opened competition and removed protectionist crutches.

If a refinery built with global expertise and billions in investment cannot compete without government shields, then what is it offering Nigerians? The same Nigerians who have already indirectly funded infrastructure through public concessions, waivers, and policy privileges now face a second tax — at the pump.

The psychological compact between citizens and the state depends on fairness. When people believe that one man or one company is being favoured at their expense, they stop seeing reform as progress. They see it as betrayal.

Mr President, economic theory often hides its human cost. But behind every fuel price increase lies a family’s rationed meal, a trader’s collapsed margin, a farmer’s unaffordable transport. The sociology of hardship is cumulative — people can absorb one reform, perhaps two, but a third breaks faith.

Nigerians are patient, but patience is not infinite. Inflation, currency devaluation, and insecurity already weigh heavily. A 15 per cent tariff on fuel is not a correction — it is cruelty wearing the mask of economic reform.

Those who drafted this proposal insist the tariff is “not revenue-driven” but “corrective.” Yet every indicator shows that the correction benefits one player. The refinery’s own petrol, as of October 20, lands at N929.72 per litre — more expensive than the N802.44 landing cost of imported petrol.

If local refining is truly efficient, why must it be shielded from competition? Why must the public pay a premium to protect inefficiency? The promise of local refining was cheaper fuel, not controlled pricing.

Even more troubling, reports confirm that the Dangote Refinery itself has imported cargoes of petrol in recent weeks, claiming they were “blending components”. If the nation’s premier refinery must import finished products, how then can it claim protection from import competition? Is it a refinery, a blender, or both?

The contradictions are too loud to ignore.

Mr President, Nigerians are not asking for perfection. They are asking for fairness. They are asking that your reform legacy not be hijacked by those who trade influence for policy.

You have often spoken of restoring Nigeria’s credibility in the eyes of investors, citizens, and the global community. That credibility depends not on who we protect, but on what we protect — fairness, transparency, and competition.

You fought cabals before; Nigerians remember. They trusted that you would never allow another to rise under your watch, this time cloaked in refinery smoke. The test is here again.

Viable alternatives exist to protect both the refinery and the community: Promote competition instead of protection by permitting multiple refiners, importers, and marketers to operate simultaneously. Increase transparency by making the cost structures and local refiners’ production capacities publicly accessible. Implement a phased approach, applying tariffs only when domestic supply exceeds dependency on imports. Conduct independent assessments, empowering the FCCPC and NMDPRA to verify if the refinery’s pricing aligns with global standards.

Mr President, every leader is tested by the counsel he keeps. Those urging this tariff are not protecting your legacy; they are protecting their leverage. They are not serving Nigeria; they are serving themselves.

If this tariff goes forward, it will not only raise prices but also fuel resentment. It will feed the belief that the government exists to protect the powerful, not the people.

You still have the chance to prove otherwise. The Nigeria you promised, open, competitive, compassionate, begins not with the policies we announce, but with the ones we refuse to endorse when they betray the people’s trust.

Respectfully submitted,

- Matthew, a policy and governance analyst, writes from Abuja