The Federal Competition and Consumer Protection Commission has set January 5, 2026, as the deadline for all digital lending platforms and intermediaries in Nigeria to fully comply with its new consumer lending regulations.

The move, announced in a statement on Thursday by the Commission’s Director of Corporate Affairs, Ondaje Ijagwu, marks a major step in the Federal Government’s effort to rein in unethical practices that have plagued the fast-growing digital lending industry.

The directive follows the introduction of the regulations, which took effect on July 21, 2025, under the Federal Competition and Consumer Protection Act 2018.

It seeks to promote fairness, transparency, and accountability across the country’s lending ecosystem.

To aid compliance, the Commission has also released accompanying Guidelines on the Digital, Electronic, Online and Non-Traditional Consumer Lending Regulations, 2025, issued under Sections 17 and 163 of the FCCPA 2018.

The statement read, “The Federal Competition and Consumer Protection Commission has set Monday, 5 January 2026, as the deadline for full compliance with the Digital, Electronic, Online and Non-Traditional Consumer Lending Regulations, 2025. The Regulations came into effect on 21 July 2025 under the Federal Competition and Consumer Protection Act 2018. It aims to promote fairness, transparency, and accountability across Nigeria’s growing digital lending market.”

To support operators in meeting the required standards, the Commission has issued an additional instrument — the Guidelines on the Digital, Electronic, Online and Non-Traditional Consumer Lending Regulations, 2025 — made under Sections 17 and 163 of the FCCPA.

The document provides practical direction for lenders and intermediaries, explains the documentation required, and introduces updated Forms 1 and 3 based on feedback received from stakeholders.

Applicants with pending submissions may provide any additional information required under the new guidelines without waiting for a formal request. The Commission will continue to process applications promptly and maintain a transparent review process.

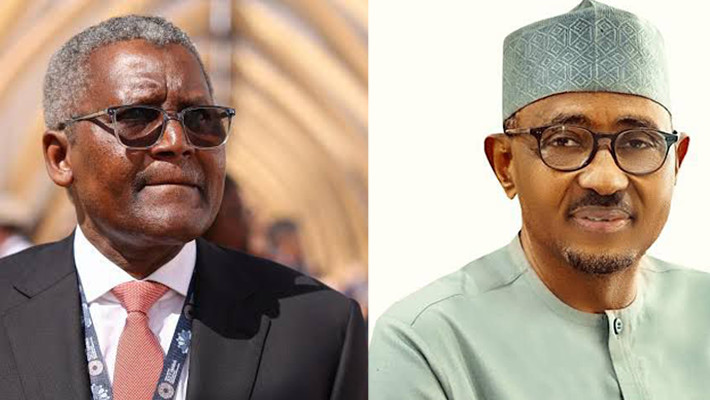

Commenting, the Executive Vice Chairman of the FCCPC, Mr Tunji Bello, stressed the importance of meeting the compliance timeline.

He explained, “Full compliance is not only a legal requirement but an important step in protecting consumers and ensuring that the sector continues to grow fairly and responsibly. Operators have had ample time to adjust to the Regulations and the additional guidance now provided. We expect all obligations to be met before the deadline.”

Under the new rules, all lending platforms, service partners, and intermediaries must meet the stipulated compliance obligations by January 5, 2026. Enforcement actions will commence immediately after the deadline, with penalties including operational restrictions, suspension of non-compliant entities, and possible prosecution under the FCCPA.

Copies of the guidelines, required forms, and frequently asked questions are available on the FCCPC’s website and through its nationwide offices.

Nigeria’s digital lending space has witnessed explosive growth in recent years, driven by the country’s large unbanked population and the ease of accessing instant loans via mobile apps. However, this boom has also bred widespread consumer abuse, privacy violations, and unethical debt recovery practices.

Many unlicensed lenders, popularly known as “loan sharks”, have been accused of charging exorbitant interest rates and resorting to public shaming and harassment to recover debts.

Some have illegally accessed customers’ phone contacts, sending defamatory messages to friends and family members of debtors.

In response, the FCCPC began a sector-wide crackdown in 2022, working with the Central Bank of Nigeria, the National Information Technology Development Agency, and the Independent Corrupt Practices and Other Related Offences Commission to create a joint task force on digital lending. This led to the introduction of an interim registration framework, under which legitimate operators were required to submit documentation for approval.

Despite these interventions, several platforms continued operating without approval, prompting the Commission to introduce the more robust 2025 Regulations and accompanying Guidelines to permanently sanitise the market.

As of November 2025, a total of 438 digital lending companies have received full approval from the Federal Competition and Consumer Protection Commission, marking a significant increase in the number of licensed operators in Nigeria’s fast-expanding online lending industry.

punch.ng

FOLLOW US ON: