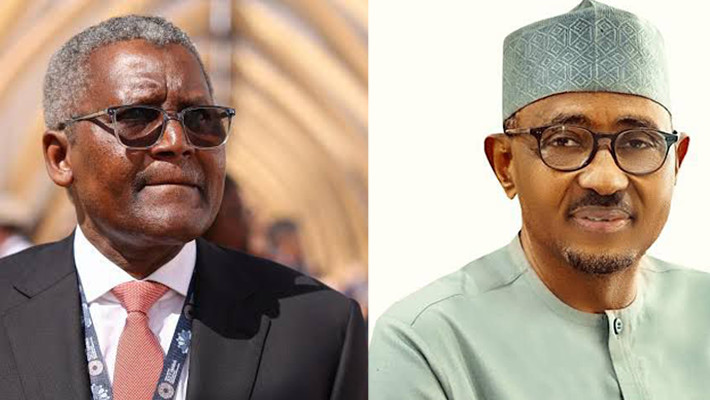

The Group Managing Director of Sahara Power Group, Kola Adesina, has said Nigeria’s power sector is entering a more stable phase that would attract investors, driven by Federal Government reforms and the gradual resolution of legacy debts that have long constrained growth across the electricity value chain.

He also revealed that Sahara Power is on course with plans aimed at increasing dispatched generation capacity to between 6,500 megawatts and 7,000 MW and is pioneering the launch of a data centre to foster expansion and innovative operations.

He noted that the group would invest heavily in both gas and renewable sources to achieve additional generation capacity within the next three to five years, with the goal being “sustainable, affordable, and reliable power for households and industries.”

Adesina, during an interview, pointed out that recent infrastructure and macroeconomic policies under President Bola Tinubu have introduced a level of clarity and predictability that is reshaping investment decisions in the sector.

He noted that the administration’s approach has helped address structural bottlenecks that previously undermined investor confidence. Similarly, Adesina disclosed that Sahara Power has already settled $438m, about 73 per cent of its original $600m loan obligation, despite longstanding liquidity challenges in the industry.

According to him, the Federal Government’s ongoing legacy debt settlement programme is critical to easing pressure on power companies, gas suppliers, and lenders, while creating room for new capital inflows.

He explained that improved policy coordination, relative exchange rate stability, easing inflationary pressures, and moderated interest rates are allowing power sector operators to plan with greater conviction.

Adesina added that these developments, combined with closer collaboration among government agencies, regulators, financiers, and industry players, were laying the foundation for sustained growth and operational stability in Nigeria’s electricity market.

He disclosed that Sahara had undertaken extensive scenario planning and aligned its strategic objectives with what he described as the president’s bold, clear-sighted, and long-term-oriented infrastructure plan, adding that the administration has shown uncommon resolve in tackling structural bottlenecks that have historically constrained investment, particularly in the energy value chain.

He noted that decisive reforms and policy clarity have significantly improved investors’ confidence, opening the door to sustained growth in the power sector and broader economic development.

The GMD said the removal of long-standing impediments had helped reposition Nigeria as a more credible destination for long-term capital. The Sahara Power chief further pointed to macroeconomic improvements as a key factor reshaping business expectations, citing clearer policy reforms in the power sector, increased stability in the foreign exchange market, a marked slowdown in inflation, and the knock-on effect of more moderate interest rates as developments that now allow investors to plan with greater certainty.

“We have done a series of scenario planning and will anchor our strategic objective on the bold, clear-sighted, long-term-oriented infrastructure plan of President Bola Tinubu. Mr President has demonstrated courage in confronting age-long bottlenecks, clearing the way for investor confidence, thereby engendering significant growth and development of the power sector and Nigeria’s economy in general.

“With clear positive policy reforms in the sector, stability in the exchange rate, significant reduction in the inflation rate, and the associated moderated interest rate, we, as well as other investors in the sector, can now easily plan with a higher sense of predictability and conviction,” he stated.

Providing updates on the state of the power sector and opportunities ahead, Adesina emphasised that from legacy debt resolution to tech-driven expansion, Nigeria would ultimately overcome its challenges to become the transformational power hub in Africa.

“We are witnessing unprecedented collaboration involving the Federal Government, the power ministry, regulatory agencies, power entities, the CBN, banks, and multilateral financial and development agencies, and other stakeholders in the power sector. We believe that this trend will continue in 2026, and this will spur sector-wide growth that will translate to greater efficiency, sustainability, and more power for Nigerians,” he said.

While commending the Federal Government for addressing the liquidity challenges in the sector through the ongoing settlement of legacy debts, Adesina said this would undoubtedly drive new investments and stabilise the sector for unhindered growth.

He stated that ‘decent progress’ had been recorded in the aspect of metering and service delivery, adding that emerging cooperation between the regulators and operators will further propel “value chain optimisation with a positive impact on end-users, directly translating to more supply reliability.”

He said the sector would witness several distribution network reforms to drive massive infrastructure rehabilitation projects, the deployment of Advanced Metering Infrastructure, and the implementation of robust Customer Relationship Management systems to enhance service delivery, reduce Aggregate Technical, Commercial, and Collection losses, and develop model business units showcasing possibilities.

He maintained that Sahara remained committed to working assiduously with all stakeholders to ensure Nigeria attains the much-sought-after future where reliable electricity becomes the bedrock of national development.

Adesina noted that the data centre will leverage real-time data analytics, predictive maintenance, and cybersecurity, working alongside the federal government and system operators to enhance overall sector efficiency and transparency.

“At Sahara, our dedication to the power sector is unwavering, as clearly demonstrated by our ambitious investments and sector leadership over the years. We will pursue strategic investments, continuing expansion and tech-led operations to ensure we serve our customers with precision, transparency and excellence,” he pointed out.

On the state of power loans, Adesina said promising conversations with the consortium of banks involved in the process are ongoing, with a positive end in sight.

According to him, the loans, which are contractually due for full payment in 2034, are being serviced diligently in keeping with all agreed terms, as the disciplined implementation plan allows the group to attract further investment and execute its expansion plans.

“Our successes at Sahara are built on a foundation of financial integrity. From inception to date, we have paid the naira equivalent of $438m (total debt serviced), which is 73 per cent of the original loan of $600m.

“This was achieved in spite of huge liquidity issues in the sector, especially the debts owed to Sahara and our gas suppliers, which, as of March 31st, 2025, were reconciled to stand at N1.514tn.

“We are grateful for the government’s intervention through the ongoing legacy debt payments, which will facilitate full settlement of all outstanding loans to the banks, our obligations to our gas suppliers, technical service providers (operations and maintenance services), and others. We are confident that the loans will be sorted out completely, as we are eager to accelerate our growth plans,” he added.

The Sahara boss believed that the government’s legacy debt resolution plan targeted at generation companies and gas suppliers would serve as a major catalyst for stabilising the value chain and restoring investor confidence.

Quoting figures from the Nigerian Electricity Regulatory Commission, Adesina stated that over 2.3 million new meters have been deployed under the National Mass Metering Programme phases since 2020.

According to him, this development has significantly reduced the national metering gap and is expected to improve revenue assurance for operators in the coming years.

He added that Sahara Power is Nigeria’s foremost power company, responsible for about 19 per cent of total power generated in the nation. Its subsidiaries include Egbin Power Plc, the largest thermal power plant in sub-Saharan Africa; First Independent Power Limited, a generating company in the Niger Delta; and Ikeja Electric, one of the largest privately run distribution companies in sub-Saharan Africa.

FOLLOW US ON: