Hundreds of Nigerian Muslims preparing for this year’s Umrah pilgrimage have been stranded after the escalating United States/Israel-Iran war disrupted flight operations across the Middle East, forcing airlines to cancel services and leaving intending pilgrims and travel agents counting millions of naira in losses.

Saturday PUNCH gathered that many of the affected pilgrims had already obtained visas and paid for flights and accommodation in Mecca and Medina before airlines began suspending services across parts of the Middle East due to the conflict.

Some of the intending pilgrims, who spoke to our correspondent, said they were scheduled to depart Nigeria between March 4 and 6 for the holy pilgrimage but were unable to travel after several airlines cancelled or suspended operations in the region.

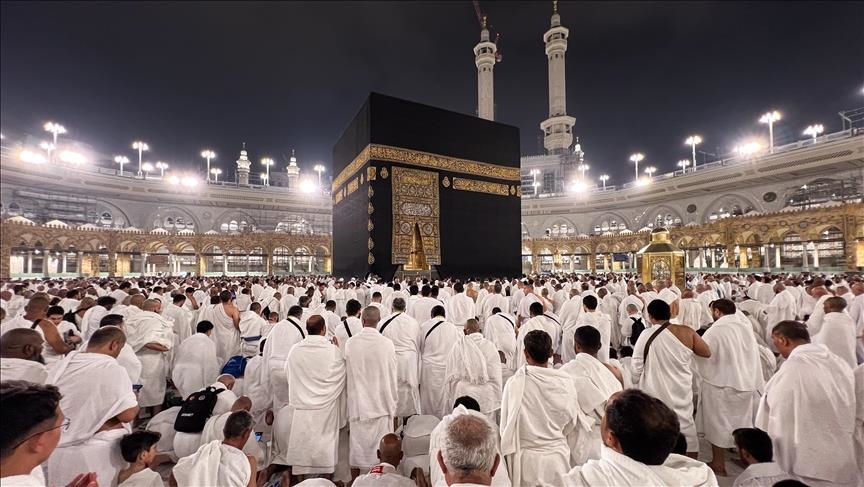

Umrah is a lesser Hajj performed by Muslims all year round in Saudi Arabia, but it usually draws large numbers of Islamic faithful during Ramadan.

Millions of Muslims usually perform Umrah during the last 10 days of Ramadan.

Available records show that over 122 million Muslims performed Umrah during the 2025 Ramadan period.

However, the scale of strikes by Iran on US military bases and other target areas in the Middle East has forced many airlines to suspend flights in Gulf states.

On February 28, US President Donald Trump and Israel declared war on Iran, killing the country’s Supreme Leader, Ayatollah Ali Khamenei, after missiles struck his office in Tehran.

Dubbed ‘Operation Epic Fury,’ both the US and Israeli militaries launched strikes against targets in Iranian cities, triggering explosions and columns of smoke.

This followed months of simmering tensions and a total collapse of diplomacy and negotiations between the US and Iran over the development of nuclear weapons by the Islamic Republic.

Speaking from the Mar-a-Lago Situation Room on Friday, Trump framed the offensive as a pre-emptive necessity to neutralise Iran’s nuclear ambitions.

Tehran also launched retaliatory missile and drone attacks across several countries in the Middle East and nearby regions, targeting US bases, allied facilities and strategic infrastructure.

Iran’s retaliation, codenamed, ‘Truthful Promise 4,’ also saw dozens of missiles launched toward Israel.

Tehran has attacked military bases and assets in about 10 countries in the region, including Saudi Arabia, Qatar, Kuwait, Bahrain, the United Arab Emirates, Jordan, Iraq and Oman.

The war resulted in the closure of critical airspace routes such as Doha and Dubai, while Iran, Iraq, Israel, Syria, Kuwait, Qatar and the UAE all announced at least partial closures of their skies after the US and Israeli attacks on Iran.

Similarly, many airlines, including Emirates, Etihad, Qatar Airways, Air France, Turkish Airlines, EgyptAir and Ethiopian Airlines, cancelled services in the region due to the tensions.

Umrah plans disrupted

The cancellation of services by the airlines disrupted the Umrah plans of many Nigerian Muslims who had made the necessary arrangements for the trip.

Saturday PUNCH gathered that a local government chairman in Ilorin, Kwara State, and two other government officials were affected by the cancellation of airline services.

The intending pilgrims, according to one of them who spoke with Saturday PUNCH on condition of anonymity, were to leave Nigeria on March 4 with Emirates Airline.

The government official disclosed that they had secured accommodation at Poinciana Hotel in Mecca and another facility in Medina.

According to him, a sum of 12,500 Riyal was paid by each of them for a hotel in Mecca for their entire stay, while those who intended to lodge in Medina had paid 7,000 Riyal per night.

“It is a painful experience that we couldn’t proceed with the Umrah trip because of the war. We had paid for everything – visa fee, accommodation, flight and other expenses. We are four in a group that wanted to go for the Umrah. A local government chairman is among us, alongside two other government officials.

“My hotel accommodation in Mecca cost 12,500 Riyal, equivalent to about N5m. Some other people that I know have also paid 7,500 Riyal per night for a room in a Medina hotel, and they booked for four nights.

“We have invested millions of naira in the trip, and our visa will expire on April 8,” he said.

The official added that the travel agent who packaged the trip for them had sought a refund from Emirates Airline, but was told they could only reschedule their trip, with the airline declining the refund request.

“Our agent has spoken with the hotel management in Mecca and Medina, but nothing concrete has come out. We were told that even if we are refunded, it would not be the full amount we paid,” he added.

Similarly, a popular butcher in Osogbo, Osun State, Rasaq (surname withheld as requested), lamented that he had spent over N13m on the Umrah trip for himself and his wife.

According to Rasaq, he and his wife were to leave for Saudi Arabia on Qatar Airways from the Murtala Muhammed Airport in Lagos on March 3 before the airline cancelled services in the Middle East.

“We were to lodge at a hotel in Medina and everything had been paid for. We were set for the trip; it cost us about N13m, including visa fees, hotel accommodation and flight tickets.

“Apart from me and my wife, two other people were going with us. We were supposed to travel in a group, but everything has been messed up for us. It is painful. Our agent is talking to Qatar Airways for a refund,” he said.

However, the agent told Saturday PUNCH that the airline could only reschedule the intending pilgrims’ flight based on his discussion with the company.

The agent, who spoke on condition of anonymity, said, “It is true that we are seeking a refund from the airline, but I am not sure it will work out. The cancellation of services in the Middle East by the airline is as a result of the war, not because of any issue from the airline.

“When things like this happen, what airlines generally do is ask the clients to reschedule their trip, and a new air ticket will be issued for them. I am also in touch with the hotel management in Medina, but I cannot disclose everything.”

This is as an Islamic cleric in Ibadan, Oyo State, Alhaji Jamiu Babatunde, told Saturday PUNCH that his planned trip was disrupted after his flight booking was cancelled.

“I was supposed to travel when Ramadan reaches the 20th day using Qatar Airways, but I received a message that my ticket had been cancelled and reopened.

“I planned to travel with my family. It was a promise I made two years ago and we had worked towards it. Now we are stranded and not sure it will be possible again this year,” he lamented.

Similarly, Ibadan-based businessman Abdullahi Abubakar said the uncertainty had also affected his business preparations ahead of the Sallah celebration.

“Beyond the spiritual aspect, I usually use the Umrah trip to buy goods to stock my shop for Sallah.

“Before now, my problem was raising the money to complete payment, but now with the situation in the region, I don’t know what to do.”

Another intending pilgrim in the Agege area of Lagos, Mrs Ramat Abdullahi, said she had decided to postpone her trip due to safety concerns linked to the regional crisis.

“This would have been my first time performing Umrah, but with the situation in the region, I decided to postpone the journey until next year,” she said.

Speaking with Saturday PUNCH, an Islamic cleric and founder of Almuhsinoon Islamic Centre, Manchester, UK, Munir Hussein, who has been facilitating Umrah trips for Muslims, said four of his team members in Nigeria could not make it to this year’s Umrah as a result of the war.

“I was meant to leave here (UK) on Monday, but we couldn’t go because the UK government issued a travel alert. Four members of my team are also in Nigeria; they were to leave on March 6, but that is no longer possible. Everything was set for our trip, but here we are.

“The airlines we were to use are asking us to reschedule, so there will not be any refund from their end. Hotels are offering zero refunds. Our losses are in many dimensions, including visa, flight, accommodation and food that had been fully paid,” he added.

Oyo businessman trapped in Mecca

Speaking with Saturday PUNCH via telephone from Makkah, an Oyo State-based businessman, Alhaji Ishola Abdulmalik, said the tensions in the Middle East had disrupted his usual Ramadan travel schedule.

“I come to Saudi Arabia every year when Ramadan is five days old and usually return to Nigeria around the 15th day to participate in my town’s annual Ramadan programme as the chairman of the organising committee. I then return to Saudi Arabia on the 25th day of Ramadan and come back home on Sallah day.

“This year, I cannot follow that routine because of the situation. Although I am stranded here because travelling has become difficult, there is no tension in Saudi Arabia. There are no restrictions and we are observing our worship normally,” he said.

Abdulmalik explained that Saudi Arabia had not shut its airspace and commercial flights were still arriving in the kingdom, but disruptions at major international transit hubs had made it difficult for many pilgrims to travel.

“I can’t leave not because Saudi Arabia has closed its airspace, but because disruptions at major connection hubs have affected travel arrangements,” Abdulmalik added.

He also revealed that some Nigerian pilgrims whose flights were cancelled were struggling to cover accommodation costs.

“There are people here, including a couple from Niger State, whose Qatar Airways flight was cancelled and they couldn’t afford to continue paying for their hotel. I had to help them settle it.

“There are others that some of us who are a little buoyant have had to support by contributing among ourselves to pay their hotel bills,” he said.

Both Emirates Airline and Qatar Airways have yet to respond to messages sent to their emails as of the time of filing this report.