The Federal Government has budgeted the sum of N1.7tn in the 2026 Appropriation Bill to settle outstanding debts owed to contractors for capital projects executed in 2024.

A breakdown of the proposed 2026 national budget shows that the amount is captured under the line item titled “Provision for 2024 Outstanding Contractor’s Liabilities,” signalling official recognition of delayed payments to contractors amid recent protests over delayed settlements.

This budgetary provision follows mounting pressure from indigenous contractors and civil society groups who, in 2025, raised alarm over unpaid contractual obligations allegedly exceeding N2tn.

Some groups under the All Indigenous Contractors Association of Nigeria had also staged demonstrations in Abuja, lamenting the severe impact of delayed payments on their operations, with many contractors reportedly unable to service bank loans taken to execute government projects.

Earlier, Minister of Works David Umahi had promised to clear verified arrears owed to federal contractors before the end of 2025. However, only partial payments were made amid revenue constraints, prompting the inclusion of the N1.7tn line item in the 2026 budget as a catch-up mechanism.

In addition to the N1.7tn for 2024 liabilities, the government has also budgeted N100bn for a separate line item labelled “Payment of Local Contractors’ Debts/Other Liabilities”, which may cover legacy debts from previous years, smaller contract claims, or unsettled financial commitments that were not fully verified in the current audit cycle.

The total N1.8tn allocation is part of the broader N23.2tn capital expenditure in the 2026 fiscal plan, which seeks to ramp up infrastructure delivery while cleaning up past obligations.

Nigeria’s contractor debt backlog has been a recurring fiscal issue, worsened by delayed capital releases, partial cash-backing of budgeted projects, and underperformance in revenue targets.

Speaking with journalists at the entrance of the Federal Ministry of Finance in December 2025, the National Secretary of the All Indigenous Contractors Association of Nigeria, Babatunde Seun-Oyeniyi, said the government’s failure to release funds after multiple assurances had forced contractors to resume protests. He said members of the association were owed more than N500bn for projects already completed and commissioned.

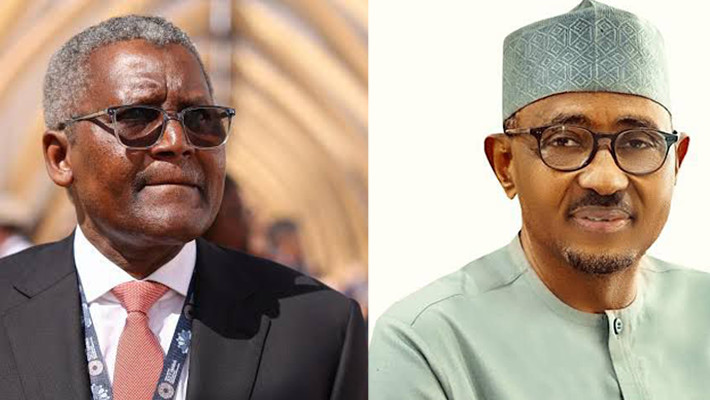

He explained that despite recent assurances from the Minister of Finance, Wale Edun, no payment had been made. “After the National Assembly intervened, they told us that they will sit the minister down over this matter. And we immediately stopped the protest,” he said.

According to him, repeated follow-up meetings with the minister had produced no tangible progress. “They have not responded to our request,” he said. “In fact, more than six times we have come here. Last week, we were here throughout the night before the Minister of Finance came.”

Oyeniyi said that although some payment warrants had been sighted, no funds had been released. “Specifically, when we collate, they are owing more than N500bn for all indigenous contractors. We only see warrants; there is no cash back.”

He accused officials of attempting to push the payments into the next fiscal year. “The problem is that they want to put us into a backlog. They want to shift us to 2026; that 2026, they are going to pay,” he alleged. “They will turn us into debt, and we don’t want that. We won’t leave here until we are paid.”

However, The PUNCH observed that earlier in August 2025, the Federal Government claimed that it had cleared over N2tn in outstanding capital budget obligations from the 2024 fiscal year, with a pledge to prioritise the timely release of 2025 capital funds.

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, disclosed this at a ministerial press briefing in Abuja, where he also declared that Nigeria is “open for business” to global investors on the back of improved economic stability.

“In the last quarter, we did pay contractors over N2tn to settle outstanding capital budget obligations. That is from last year,” Edun said. “At the moment, we have no pending obligations that are not being processed and financed. And the focus will now shift to 2025 capital releases.”

By December 2025, The PUNCH reported that President Bola Tinubu expressed “grave displeasure” over the backlog of unpaid federal contractors and set up a high-level committee to resolve the bottlenecks and fund repayments.

Briefing State House correspondents after the Federal Executive Council meeting in Abuja, Special Adviser on Information and Strategy, Bayo Onanuga, said the President was “upset” after learning that about 2,000 contractors are owed. “He made it very, very clear he is not happy and wants a one-stop solution,” Onanuga told journalists.

Tinubu directed the setting up of a committee to verify all claims from federal contractors. The new budget’s provisions are expected to draw from the outcome of that verification exercise and may be disbursed in tranches based on confirmed and certified claims.

The total proposed 2026 national budget stands at N58.47tn, with N23.2tn earmarked for capital expenditure, N15.9tn for debt servicing, N15.25tn for recurrent spending, and N4.09tn for statutory transfers.

punch.ng

FOLLOW US ON: