Despite its transition into a commercial entity, the Nigerian National Petroleum Company Limited is grappling with mounting financial pressure as unviable and underperforming subsidiaries deepen inter-company indebtedness, pushing outstanding obligations owed to the company to N30.30tn.

Latest findings from NNPC’s 2024 audited financial statements showed that debts owed by subsidiaries, joint ventures, and other related entities rose by 70.4 per cent, or N12.52tn, from N17.78tn in 2023 to N30.30tn as of December 31, 2024. The sharp increase has raised fresh concerns about the company’s liquidity management and long-term financial sustainability.

An analysis of the audited accounts, recently released by the oil firm, conducted on Sunday, revealed that several of the national oil company’s core operating subsidiaries—particularly its refineries, trading arms, and gas infrastructure units—accounted for the bulk of the ballooning intercompany receivables.

The report showed that while the national oil company operates 32 subsidiaries, only eight are not indebted to the parent company, leaving the majority burdened with varying levels of inter-company debt.

This development comes as NNPC continues to navigate concerns surrounding the write-off of substantial debts owed to the Federation and advances plans to divest non-core assets as part of its ongoing transformation into a profitable, commercially oriented national oil company.

Last week, The PUNCH exclusively reported that President Bola Tinubu approved the cancellation of a significant portion of the debts owed by NNPC to the Federation Account, wiping off about $1.42bn and N5.57tn after a reconciliation of records between both parties.

The company has also begun moves to sell stakes in some of its oil and gas assets.

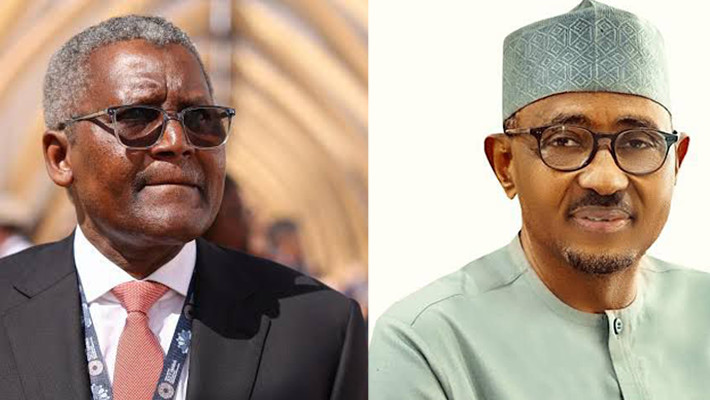

Announcing the company’s 2024 financial results, Group Chief Executive Officer, Bashir Bayo Ojulari, said NNPC recorded a Profit After Tax of N5.4tn on the back of N45.1tn in revenue for the year, representing increases of 64 per cent and 88 per cent respectively over the 2023 figures.

Despite these strong headline numbers, the surge in inter-company debts to N30.30tn underscores the need for a rethink of liquidity strategy and balance-sheet management if the company is to sustain profitability and successfully execute its planned divestments and restructuring.

Topping the list of subsidiaries owing NNPC is the Port Harcourt Refining Company Limited, which posted inter-company debts of N4.22tn in 2024, up sharply from N2.00tn in 2023. This reflects the financial strain associated with years of rehabilitation spending and prolonged operational downtime.

Next was the Kaduna Refining and Petrochemical Company Limited, whose obligations rose to N2.39tn from N1.36tn a year earlier, while the Warri Refining and Petrochemical Company Limited owed N2.06tn, up from N1.17tn in 2023.

The PUNCH reports that although the Port Harcourt, Warri, and Kaduna refineries have undergone several rounds of turnaround maintenance aimed at boosting domestic refined petroleum output, they have yet to operate sustainably at commercially viable levels.

As a result, they remain largely dependent on continued financial support from the parent company, contributing significantly to rising inter-company debts reflected in NNPC’s 2024 accounts.

NNPC’s trading operations also featured prominently, with NNPC Trading SA owing the parent company N19.15tn, more than double the N8.57tn recorded in the previous year.

Smaller but notable receivables were recorded from NNPC Gas Infrastructure Company Limited (N847.98bn), Nigerian Pipelines and Storage Company Limited (N466.74bn), Maiduguri Emergency Power Plant (N179.33bn), NNPC Eighteen Operating Limited (N681m), NNPC Trading Services (UK) Limited (N1.97bn), Nidas Shipping Service Agency Limited (N1.26bn), Kaduna IPP Limited (N1.83bn), Kano IPP Limited (N1.47bn) and Hyson Nigeria Limited (Joint Venture) (N102m).

Other subsidiaries with outstanding balances include Petroleum Products Marketing Company Limited (N264.75bn), NNPC Medical Services Limited (N106.75bn), NNPC Shipping and Logistics Limited (N99.99bn), NNPC Gas Marketing Company Limited (N54.71bn), NNPC Engineering and Technical Company Limited (N50.86bn), Gwagwalada Power Limited (N326.58bn), National Petroleum Telecommunication Limited (N26.37bn), NNPC LNG Limited (N28.22bn), NNPC Properties Limited (N18.94bn), and NNPC New Energy Limited (N5.51bn).

In total, amounts owed by related parties climbed from N17.78tn in 2023 to N30.30tn in 2024, underscoring deepening liquidity pressures within the NNPC group structure.

Conversely, the report showed that NNPC’s obligations to its subsidiaries and related entities also increased, rising to N20.51tn in 2024 from N14.17tn in 2023, representing a 44.7 per cent year-on-year increase.

The bulk of this exposure relates to NNPC Trading Limited, to which the national oil company owed N16.36tn as of December 2024, up sharply from N6.70tn a year earlier.

Similarly, NNPC Exploration and Production Limited was owed N4.02tn, down from N4.85tn in 2023, while smaller balances were recorded for NNPC Retail Limited (N10.95bn), NNPC HMO (N3.47bn), Antan Producing Limited (N7.20bn) and NNPC Gas Infrastructure Company Limited (N106.97bn).

The sharp rise in inter-company balances reflects lingering financial complexities arising from NNPCL’s transition from a state corporation to a limited liability company under the Petroleum Industry Act.

The swelling debts come amid the company’s renewed push to divest non-core assets, improve liquidity and attract external capital. NNPCL has repeatedly signalled plans to sell stakes in refineries, pipelines, power plants and other infrastructure assets to strengthen its balance sheet.

Recently, the company confirmed it was reviewing its asset portfolio to unlock value, reduce debt exposure and reposition itself as a commercially viable national oil company capable of competing globally.

Energy experts say resolving inter-company receivables and payables will be critical if NNPC is to execute its asset-sale plans successfully and reassure potential investors of its financial discipline.

Commenting, petroleum economist Prof Wumi Iledare said NNPC must begin operating as a true commercial holding company by enforcing strict settlement timelines among subsidiaries and ending the practice of allowing inter-company obligations to linger indefinitely.

He warned that the N30.3tn inter-company debts recorded in NNPC’s 2024 audited accounts point to deep-rooted structural and governance weaknesses, rather than outright insolvency.

In a personal note reacting to The PUNCH report titled “NNPC’s N30.3tn Debt, A Simple Way to See It from PEWI’s Lens,” Iledare said the scale and pace of the debt build-up should raise red flags, particularly as it represents a 70 per cent increase within a single year.

“The audited report showing N30.3tn in debts between NNPC and its subsidiaries should worry us, not because NNPC is ‘bankrupt,’ but because it exposes a deep structural problem.

“Most of this debt is NNPC owing itself. That usually happens when subsidiaries keep operating without paying for crude, products, or services, while losses are quietly carried forward. But a 70 per cent jump in one year is a clear warning sign. It means inefficiencies are growing faster than reforms.

“Only eight out of 32 subsidiaries being debt-free tells us this is not bad luck; it is weak commercial discipline,” he said.

Iledare stressed that the issue could not be dismissed as operational misfortune, noting that the solution lies in enforcing strict commercial rules rather than writing off debts.

“Even internal debt affects operations. Cash that should go into maintenance, investments and growth is tied down. Profitable units end up subsidising weak ones. Over time, accountability disappears, and performance suffers. The real fix is not debt forgiveness.

“NNPC must act like a true commercial holding company: enforce settlement timelines between subsidiaries, restructure or merge non-viable entities, clearly separate legacy pre-PIA debts from new obligations, and hold subsidiary CEOs accountable for cash flow and profitability,” he added.

He concluded that the rising inter-company debt burden represents a defining moment for the restructured national oil company.

“Bottom line: this debt is a governance test, not just an accounting number. If tolerated, it will recreate the old NNPC problems under a new name. If confronted honestly, it can become the turning point toward a truly profitable, PIA-compliant NNPC.”

Also commenting, the Chief Executive Officer of Petroleumprice.ng, Jeremiah Olatide, said the 70 per cent increase from 2023 reflects “financial recklessness” within the national oil company. “The N30.3tn debt owed by NNPCL and its subsidiaries is quite alarming,” Olatide told The PUNCH.

“A 70 per cent increase from 2023 represents financial recklessness. This debt burden could have a largely negative impact on the company’s operations, given that 25 out of 33 subsidiaries are in debt.

“If not for the intervention of the Federal Government to cancel $1.42bn in legacy debts to ease financial pressure—which is commendable—NNPCL management would be under even greater strain. However, the cycle of debt must be urgently addressed, as it will be detrimental to future operations,” he said.

Olatide added that a strong debt-management framework is essential for NNPCL’s sustainability. “Going forward, proper debt management and restructuring, combined with regular audits and transparent reporting, will enhance accountability and help mitigate the recycling of debts within the group,” he said.

Meanwhile, NNPC’s borrowings more than doubled in 2024, rising from N55.7bn in 2023 to N122.8bn, according to the company’s audited financial statements. The increase, driven largely by new loan arrangements and accrued interest, reflects efforts to fund strategic projects such as the Gwagwalada Independent Power Project.

The report showed that the company added N44.36bn in new borrowings during the year, alongside N1.69bn in interest and an exchange adjustment of N4.02bn, bringing total borrowings to N122.76bn as of December 31, 2024.

Of this amount, N70.56bn was classified as current borrowings, while N52.20bn was non-current, highlighting repayment obligations extending beyond 12 months.

According to the report, loan facilities were extended by NNPC E&P Limited and The Wheel Insurance Company to fund the Gwagwalada IPP. NNPC E&P disbursed N92bn in 2023, repayable over four years with a one-year moratorium on principal repayment, while The Wheel Insurance provided N46bn in 2024, repayable over one year with a six-month moratorium. Interest on both facilities accrues at 30-day Term SOFR plus a four per cent margin, with an additional liquidity premium applied to the NNPC E&P loan.

The report also indicated that the consolidated group reported no borrowings in both 2023 and 2024, suggesting that these liabilities are company-level obligations and do not reflect debt at the subsidiary or joint-venture level.

The surge in loans comes as NNPCL continues to manage complex inter-company debt dynamics, with subsidiaries owing the parent company N30.3tn as of 2024, raising further questions about internal cash management and the financial sustainability of certain units within the group.

FOLLOW US ON: