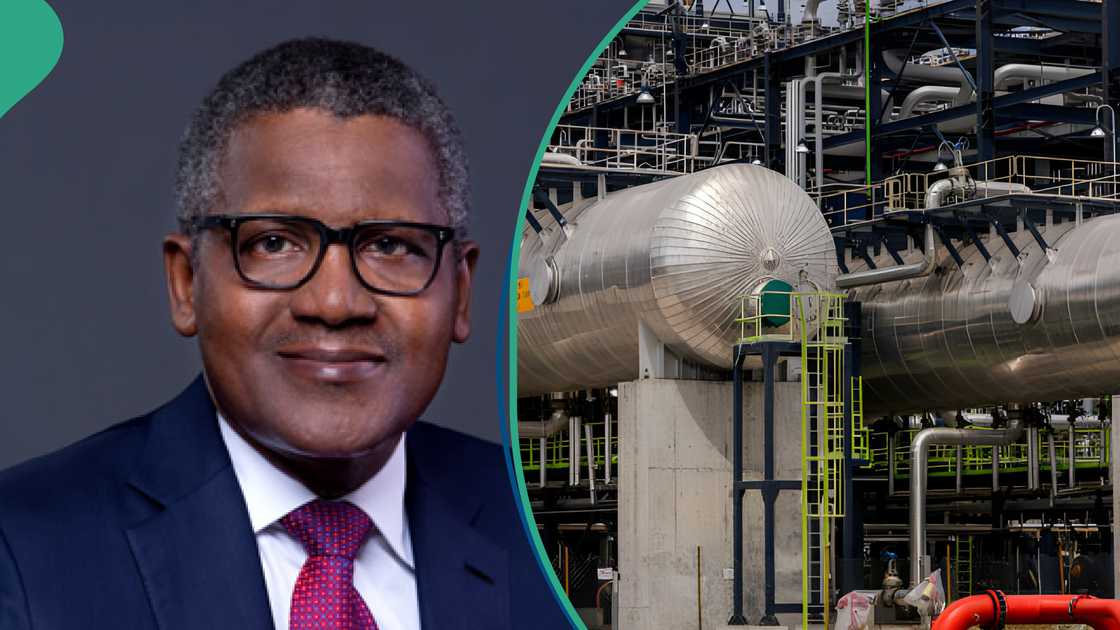

Refineries in India are buying Nigerian crude while the country’s Dangote Petroleum Refinery is largely running on American oil.

In a twist that underscores the complexities of global oil trade, India’s state refiners are snapping up Nigerian crude oil while Africa’s largest refinery, located in Nigeria, is increasingly importing crude from the United States, a development that oil sector operators described as “oil trade irony” on Sunday.

Industry sources told Reuters that Indian Oil Corporation recently bought one million barrels of Nigeria’s Agbami crude for September delivery in a tender awarded to global trader Trafigura. The purchase is part of a broader sourcing spree that has seen Indian refiners secure millions of barrels from non-Russian sources.

Ironically, while Indian refiners are boosting purchases of Nigerian grades, the $20bn Dangote Petroleum Refinery in Lagos is relying heavily on US imports to feed its processing units. The refinery imported an average of 10 million barrels in July, saying it was increasingly relying on the US for its feedstock despite the naira-for-crude deal with the Federal Government.

Reuters reported that Indian Oil Corp and Bharat Petroleum have bought a million barrels of non-Russian crude for delivery in September and October after the US pressured India to halt purchases from Russia.

Indian state refiners had been largely absent from the spot market since 2022, instead becoming one of the few purchasers of cheaper Russian crude after Russia invaded Ukraine. However, they paused Russian purchases in late July after pressure from US President Donald Trump.

Over two million barrels of crude oil were said to have been bought from Nigeria for September and October deliveries in India. India’s second biggest state refiner BPCL bought barrels of oil through negotiations for September arrival, a source familiar with the purchases said.

That included one million barrels of Angola Girassol, one million barrels of US Mars, three million barrels of Abu Dhabi Murban, and two million barrels of Nigerian oil, according to Reuters.

Dangote imports US oil

Data from commodities analytics firm, Kpler, showed that in July, US barrels accounted for about 60 per cent of Dangote’s 590,000 barrels per day of crude intake, with Nigerian grades making up the remaining 40 per cent.

In July, the Dangote refinery’s crude imports surged to a record 590 kbd—driven largely by US barrels overtaking Nigerian supply for the first time—amid ongoing domestic sourcing challenges, Kpler reports. The refinery is currently operating at 85 per cent of its nameplate capacity with plans to upgrade to 700,000 barrels per day.

As crude imports into the Dangote refinery surged to 590,000 bpd in July, the highest monthly volume on record, Kpler noted that US crude made up a substantial 370,000bpd (60 per cent) of the total, while Nigerian grades accounted for just 220,000 bpd (40 per cent), primarily comprising Amenam, Bonny Light, and Escravos.

“While WTI has held a significant share in Dangote’s import slate since March, this is the first time US crude has overtaken Nigerian supply—a shift driven by several factors,” Kpler reported. It stated that WTI has been more competitively priced than certain domestic options, especially as US barrels struggled to find traction in Asia amid rising OPEC+ output and multi-month lows in Murban spot premiums in May.

At the same time, the Dangote refinery had earlier said that securing domestic crude for the refinery had remained an ongoing challenge. Dangote and other local refineries have decried the low supply of crude to their facilities in conformity with the Domestic Crude Supply Obligations.

Dangote’s crude inventories rose to 6.73 million barrels in July, reflecting a 2.5 Mbbls month-on-month increase, suggesting that a portion of the elevated import volumes has been directed into storage.

Meanwhile, Nigeria’s indigenous oil firms are increasingly taking centre stage in the upstream sector, leveraging the withdrawal of international majors and improved stability in onshore operations. Crude and condensate supply held steady at 1.75 Mbd in July, lifting the three-month average to its highest level in over five years, driven by rising onshore output and fewer pipeline disruptions.

At Jones Creek, reduced pipeline outages reportedly supported higher flows to the Ugo Ocha terminal, with exports doubling to 65,000 bpd in recent months. Kpler stated that among key grades, CJ crude production reached its highest level of the year in June, reaching 55,000 bpd, quoting data from the Nigerian Upstream Petroleum Regulatory Commission. The grade, which is previously a regular feedstock for Dangote, reportedly had its recent cargoes shipped to Canada’s Point Tupper and re-exported to the US recently.

The refinery’s intake of domestic crude declined to 220,000 bpd in August, down from 275,000 bpd last month, coinciding with record-level imports from the US at 370,000 bpd. Despite its stated intention to prioritise Nigerian supply, Dangote’s current crude slate suggests a more flexible sourcing strategy, which will largely be based on commercial incentive.

The bulk of the refinery’s output consists of gasoline, primarily sold domestically, though some volumes have been exported to Oman and Ivory Coast—and jet fuel, destined for West Africa and Northwest Europe, according to Kpler.

Last month, the President of the Dangote Group, Aliko Dangote, said the refinery has made Nigeria a net exporter of refined products, saying, “From June beginning to July, we have exported about 1 million tonnes of PMS, within the last 50 days,” he said.

It was stated that with a gasoline yield of 46 per cent, the refinery’s expansion to 700,000 barrels per day (bpd) would increase potential gasoline output to 322,000 bpd, up from an initial 300,000 bpd.

However, the platform expressed pessimism, stating that “expecting Dangote to run at full capacity on a sustained basis would be highly optimistic, given the likelihood of frequent mechanical issues and ongoing maintenance requirements. As such, we do not anticipate the refinery approaching full utilisation before Q4 2026.”

It disclosed that, in an effort to maximise gasoline yields, condensate naphtha arrived in early July, with Dangote importing around 22,000 tonnes per month (6,000 bpd) to feed its hydrotreater for gasoline production.

These naphtha imports, it was learnt, underscore “ongoing operational challenges at the refinery’s 204,000 bpd RFCC unit, which has been grappling with reactor and regenerator issues since January.”

Looking ahead, Kpler expects Nigeria’s crude and condensate supply to average around 1.65 mbd throughout the rest of the year—a stable level, with no significant new fields expected in the coming months, though still a marginal increase compared to H2 last year.

Nevertheless, it was added that activity among local producers continues to build, with significant gains possible from next year. “Companies like Seplat are working to boost output by restarting shut-in wells and launching new drilling campaigns across the former ExxonMobil blocks, according to their latest financial results.

“Infrastructure is also expanding: the Otakikpo terminal, developed by Green Energy, completed its first crude export in June aboard the Suezmax Lipari, becoming Nigeria’s first privately built onshore terminal in over five decades. Conoil has completed its first Obodo crude shipment, while Renaissance Africa Energy is preparing to scale up production following its acquisition of Shell’s onshore assets,” it was reported.

FOLLOW US ON:

FACEBOOK

TWITTER

PINTEREST

TIKTOK

YOUTUBE

LINKEDIN

TUMBLR

INSTAGRAM