Nigerians will pay an additional amount of about N1tn (N973.6bn) annually on petrol imports following the Federal Government’s planned introduction of a 15 per cent import tariff on Premium Motor Spirit (petrol).

According to a petrol import trend report obtained from the Nigerian Midstream and Downstream Petroleum Regulatory Authority, reviewed by The PUNCH on Tuesday, Nigeria imported an average of 26.75 million litres of petrol daily between January and September 2025.

At a projected import tariff rate of N99.72 per litre, as stated in the presidential approval letter for the 15% tariff, the amount that would be spent as tariff for the 26.75 million litres would be about N2.67bn daily.

When computed over a full year, this adds up to a staggering N973.64bn, which Nigerians will ultimately bear through higher pump prices once the policy is implemented. This amount, while representing additional revenue for government coffers, will translate to a direct increase in fuel expenses for households, transporters, and businesses nationwide.

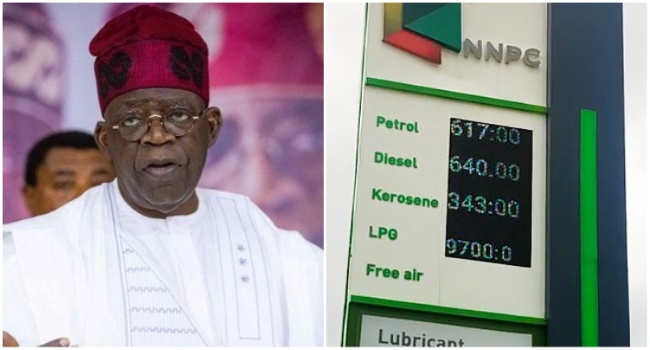

President Bola Tinubu’s approval of a 15 per cent import policy on PMS and diesel has stirred widespread concern across the oil and gas sector, with operators warning it could raise petrol prices, worsen inflation, and increase import costs, even as the government insists the policy aims to boost local refining and generate revenue.

The President’s approval was conveyed in a letter signed by his Private Secretary, Damilotun Aderemi, following a proposal submitted by the Executive Chairman of the Federal Inland Revenue Service, Zacch Adedeji.

The proposal sought the application of a 15 per cent duty on the cost, insurance, and freight value of imported petrol and diesel to align import costs with domestic market realities.

Adedeji, in his memo to the President, explained that the measure formed part of ongoing fiscal and energy reforms designed to strengthen the naira-based oil economy, ensure price stability, and accelerate the nation’s transition toward local refining capacity in line with the administration’s Renewed Hope Agenda for energy security and economic sustainability.

He also advised the government to ensure transparency by creating a designated Federal Government revenue account managed by the Nigeria Revenue Service, with verification and clearance oversight by the NMDPRA.

“At current CIF (Cost, Insurance, and Freight) levels, this represents an increment of approximately N99.72 per litre, which nudges imported landed costs towards local cost recovery without choking supply or inflating consumer prices beyond sustainable thresholds.

“The core objective of this initiative is to operationalise crude transactions in local currency, strengthen local refining capacity, and ensure a stable, affordable supply of petroleum products across Nigeria,” Adedeji stated.

The FIRS boss noted that the policy is not revenue-driven but corrective, introduced to align import costs with local production realities and prevent duty-free imports from undercutting domestic refineries that are just beginning to recover.

He argued that the new tariff framework would discourage duty-free fuel imports from undercutting domestic producers and foster a fair and competitive downstream environment. He also warned that the current misalignment between locally refined products and import parity pricing has created instability in the market.

“While domestic refining of petrol has begun to increase and diesel sufficiency has been achieved, price instability persists, partly due to the misalignment between local refiners and marketers,” he wrote. The new policy takes effect after a 30-day transition period expected to end on November 21, 2025.

Dissenting voices

In response to the development, dissenting voices from industry experts and petroleum marketers have continued to grow louder, with many questioning the timing and potential impact of the 15 per cent import tariff.

The Independent Petroleum Marketers Association of Nigeria on Tuesday expressed reservations over the newly approved 15 per cent import tariff on petrol and diesel, describing it as inconsistent with the spirit of market deregulation.

Speaking in an interview with our correspondent, the National Publicity Secretary of IPMAN, Chinedu Ukadike, said independent marketers were not opposed to Tinubu’s directive but faulted the policy’s design, which he argued undermines the principles of a free and competitive market.

“Independent marketers don’t have any problem with the President’s directive, but the only issue is that because of policymakers, the policy doesn’t follow the spirit of deregulation,” Ukadike said.

“Once you liberalise the market and then start to favour a certain section of the industry against others, it means you are putting the cart before the horse. The liberalisation was meant to ensure a free market driven by a willing buyer, willing seller arrangement. The policy should not be an impediment for those who want to import to challenge the local industry.”

He urged the Federal Government to focus on incentivising local refineries rather than imposing tariffs on fuel imports, noting that such measures could distort competition and discourage private participation.

“The government should rather encourage local refineries by giving them crude and reducing taxes for local refiners so that they can lower their prices. The important thing is the price war between refineries and importers. One thing I know is that there is no way domestic products will be cheaper, and marketers will still decide to import. There is no need to put a tariff on importation because they would know importing is not lucrative and would source products locally. So we must do everything to boost our market and solve issues. The government has to allow domestic refiners and importers to compete without government-induced favouritism,” he advised.

According to Ukadike, the natural dynamics of market forces would make imports unattractive once local production becomes cheaper. “There is no need to put a tariff on importation because once domestic products are cheaper, marketers will naturally source locally. The government must allow domestic refiners and importers to compete freely without government-induced restrictions,” he explained.

He warned that any artificial increase in fuel prices would further drive inflation, especially ahead of the Yuletide season when demand for petrol typically rises.

“The most important element of market forces is a price drop. Any addition in pricing will lead to inflation, especially now that Christmas is approaching and more people will be travelling. There must be no shortage of products, and the government must ensure local refining, distribution, and collaboration with stakeholders are in full gear,” Ukadike added.

The Chief Executive Officer of PetroleumPrice.ng, Jeremiah Olatide, described the newly approved 15 per cent import tariff on petrol and diesel as a double-edged policy, one that could boost government revenue but also worsen the economic hardship faced by Nigerians.

Reacting to the development, the oil market analyst said the tariff would significantly impact fuel prices and inflation levels, especially as Nigerians continue to adjust to the effects of the fuel subsidy removal.

“Yes, that calculation is accurate,” he told The PUNCH in response to estimates showing Nigerians may pay nearly N1tn extra annually on petrol imports due to the new tariff. Although the figure can go higher because we are still in the current year, depending on landing costs, too.”

According to him, while the policy represents a strategic move to shore up revenue amid fiscal constraints, it comes at a difficult time for most Nigerians. “For me, it is a good thing that revenue will increase. It’s a smart way to generate income for the country, considering our current expenses and the need for multiple revenue streams.

“But the timing is not really good. Nigerians are still struggling to buy petrol at N800 or N900 per litre. Subsidy removal happened two years ago and has already taken a toll on households. Adding extra expenses through a tariff will hit them hard and definitely push up inflation,” he explained.

He also warned that a combination of the 15 per cent import duty and a proposed five per cent surcharge could further burden consumers and distort market stability.

He said, “The timing is not really good. Two years ago, the subsidy was removed. The effect has not reduced, and we are already facing another issue. The government also plans to begin a five per cent surcharge soon. All of these just make them an additional burden on Nigerians. The government has to be strategic in the rollout.

“I know they are trying to protect local refineries, but there are better policies and ways to support them without having to put more burden on Nigerians. The government could have prioritised a naira-for-crude deal instead.”

The energy expert further noted that the tariff would not necessarily halt fuel importation, as some traders might still find ways to bring in products despite the higher cost.

“I am so sure that some importers will still import. They will find ways to import, not minding the challenges. This policy will not ease out importation of products. Some importers will still look for ways to import, and all of that will still be added to the pump price. Nigerians are craving a price drop, but with these multiple taxes coming into play, that hope seems far away,” he lamented.

He urged the government to adopt policies that strengthen local refining and stabilise the upstream oil sector instead. “The right policy should be enhancing the naira for crude deals to all local refineries. All of them should take feedstock in naira. It would help them grow faster.

“The government should look into the upstream sector and make sure a production of three million barrels per day of crude is ensured. There will be stability with this. Patronage will also increase if prices drop. That’s the only way to achieve price stability and increase market confidence,” he said.

Meanwhile, the Petroleum Products Retail Outlets Owners Association of Nigeria earlier called for the resuscitation of the country’s refineries before December to avert possible fuel scarcity and price hikes during the festive season.

PETROAN President, Billy Gillis-Harry, described the tariff policy as a bold step toward protecting domestic refineries, stabilising the market, and promoting energy security. He, however, warned that if the measure was poorly implemented, it could cripple fuel importation and render many importers jobless, a situation he said would lead to fuel scarcity.

“NNPC must complete its partnership agreements quickly and start production at Nigeria’s refineries before December to avert any form of fuel scarcity or price hike during the Yuletide season,” he said.

Despite the additional costs Nigerians are expected to bear, the policy decision by the government has also attracted commendations from some stakeholders who view it as a bold step toward boosting revenue and encouraging local refining.

CPPE backs govt

The Centre for the Promotion of Private Enterprise threw its weight behind the Federal Government’s newly introduced 15 per cent import duty on refined petroleum products, describing it as a step toward reviving Nigeria’s industrial base and promoting economic self-sufficiency.

The private sector think tank said the measure represents a “strategic protectionist policy” designed to safeguard emerging domestic industries, including local refineries, while stimulating productivity, job creation, and foreign exchange savings.

In a statement signed by the Director and Chief Executive Officer of the Centre for the Promotion of Private Enterprise, Muda Yusuf, the CPPE noted that Nigeria’s excessive dependence on imports over the past decades had weakened its productive capacity, eroded competitiveness, and exposed the economy to external shocks.

It argued that sectors previously protected through calibrated policy interventions, such as cement, flour, and beverages, have recorded remarkable growth and value addition, proving that well-targeted protectionism can strengthen national industries.

The group clarified that its position does not support economic isolationism but a measured approach to industrial protection that helps domestic industries scale up and compete globally.

“Strategic protectionism is not about closing borders or creating monopolies,” CPPE said. “It is about building domestic capacity to engage the global economy from a position of strength.”

The organisation described the 15 per cent import tariff on petrol and diesel as a progressive and corrective policy, adding that it could help level the playing field for domestic refiners such as the Dangote Refinery, NNPCL refineries, and modular plants currently struggling to compete with cheaper imports.

While commending the tariff, CPPE stressed that protection alone would not guarantee industrial success. It urged the government to complement the measure with fiscal incentives, low-cost financing, affordable and reliable energy supply, strategic infrastructure investment, and streamlined regulatory processes.

According to the centre, these support structures are critical to ensuring that protection leads to lower production costs, price stabilisation, and improved consumer welfare in the long run.

punch.ng

FOLLOW US ON: