The Natural Oil and Gas Suppliers Association of Nigeria has warned that the Dangote Petroleum Refinery’s plan to bypass existing distribution channels and supply refined petroleum products directly to end-users would lead to a nationwide disruption, long-term product scarcity, and the collapse of existing supply networks.

The oil and gas suppliers called on the refinery to halt its plan and seek further dialogue before commencing the distribution of products to end users, urging it to learn from what happened to non-functional refineries under the management of the Nigerian National Petroleum Company Limited.

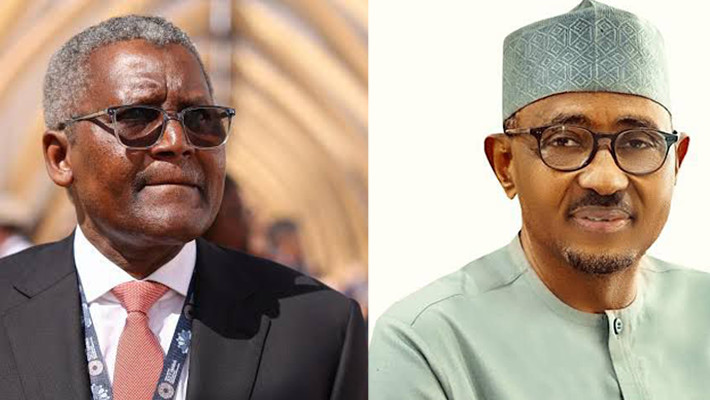

They also called on President Bola Tinubu to intervene in the issue, stressing that Dangote alone cannot handle nationwide distribution of products sustainably. The NOGASA National President, Bennett Korie, made the call during the association’s Annual General Meeting held on Thursday in Abuja.

However, an official of the Dangote Group described the position of the dealers as anti-Nigeria, arguing that the plan by Dangote was to remove the cost of logistics in the movement of petrol nationwide.

Speaking with The PUNCH, while reacting to the development, the National President of the Petroleum Products Retail Outlet Owners Association of Nigeria, Billy Gillis-Harry, said Nigerians should not rejoice yet over the announcement by the Dangote refinery, as he backed the sister oil marketing group, NOGASA.

Meanwhile, it was observed on Thursday that the prices of petrol at depots spiked by up to seven per cent, from the N815 per litre it sold on Wednesday to N870 per litre on Thursday.

Recall that the $20bn Dangote refinery recently disclosed plans to deploy 4,000 new Compressed Natural Gas-powered tankers for nationwide distribution of petrol and diesel directly to marketers, manufacturers, telecom firms, aviation companies, and other large consumers, bypassing traditional depots and intermediaries.

The refinery took delivery of 4,000 new CNG-powered trucks for its fuel distribution initiative, scheduled to be launched on August 15. The initiative, which is intended to provide more efficient transportation across Nigeria and beyond, has been applauded by some industry experts. With the investment of N720bn, the initiative is expected to save Nigerians over N1.7tn annually, and lift 42 million Micro, Small, and Medium Enterprises by reducing energy costs and enhancing profitability.

The refinery said the strategic programme is part of its broader commitment to eliminating logistics costs, enhancing energy efficiency, promoting sustainability, and supporting Nigeria’s economic development.

However, Korie, speaking in his address, said if existing retail outlets were forced out of business due to Dangote’s direct distribution approach, it would be difficult to revive the supply chain in the event of any disruption at the refinery.

He further warned that handling refining, distribution, and retail through filling stations as a single entity is unsustainable, citing the failed attempt by the Nigerian National Petroleum Company Limited at direct distribution. He stated that the state-owned refineries began to decline after the oil company ventured into retail distribution.

“We are pleading that Mr President should intervene in this matter by telling Dangote to slow down, and go by the rules of the game. Nobody’s against the refinery. If there’s anybody who supported Dangote Refinery more than any other organisation, it is this association.

“But when this issue came up, we said, no, we need to advise, we need to give you an idea how to go about it. What is important to us is that the refinery is blending, the product is coming out, and Nigerians are enjoying the product that is blended today.

“Now, some Nigerians will be thinking maybe because we don’t want him to do this or because of competition. No, it is because we don’t want what happened to NNPCL to happen to Dangote Refinery. The reason is that, before now, NNPC refined products and distributed them through their subsidiary at that time.

“And everything was moving smoothly, it wasn’t bad. Until people who I think advised Dangote today, went to advise NNPC to start doing distribution directly, which is the filling station that you have in NNPC filling stations. As soon as this NNPC filling station started, that was when our refinery started going down,” Korie said, warning that the same fate could befall Dangote’s $20bn refinery if it follows a similar path.

Korie stressed that while the association fully supports the operations of the Dangote refinery, the decision to bypass traditional distributors poses a serious threat to existing supply structures and could replicate the challenges that undermined the NNPCL in the past.

He warned that handling refining, distribution, and retail through filling stations as a single entity is unsustainable. “Because they were concentrating on their filling stations. I am not saying they are not paying attention to refineries, but you can’t do it alone. You are blending, you are refining, and at the same time operating, and again, add a filling station in your operation.

“You will have a problem. That is why today you have this problem of our refineries not working. So because of this, we now say, No, please don’t go there. Concentrate on this thing you are doing. You are doing good. You are finding the product good, sell to the marketers, marketers sell to the end users. Remove your hand from this direct distribution. It will bring you problems, and once you start solving that problem, you will not have time to fix the refinery or operate the refineries very well.

“So it’s important that you concentrate on this refinery. Blend enough for us and sell some to other countries. And that way, the job there will be stable, and our own here will be stable. We are capable of distributing the product. All we need you to do, blend, sell to depot owners, and they will go there and buy, and distribute to the end users. That way, you balance the system.”

He further expressed NOSAGA’s readiness to work with the Refinery to ensure that the business survives for the mutual benefit of all involved. The NOGASA president added, “During our last meeting, we supported the completion of the refinery, but most of our members are afraid of the giant monopoly.

“The entire giant’s indirect distribution of their products with the purchase of 4,000 distribution trucks for nationwide supply makes us worried about staying in the business. We wish to assure that they consider the small suppliers who depend on those business employee levels. We need to work with them to ensure that our business survives for the mutual benefit of all involved.”

Korie noted the economic impact of such centralisation, stating that thousands of Nigerians working across over 50,000 filling stations and logistics chains could be displaced if independent marketers are sidelined. He called on the government to facilitate dialogue between Dangote Group and key industry stakeholders, including major and independent Petroleum marketers among others.

Also speaking, the National President of the Petroleum Products Retail Outlet Owners Association of Nigeria, Billy Gillis-Harry, said Nigerians should not rejoice yet over the announcement by the Dangote refinery to distribute petroleum products across the country, as there is always payback time.

“We don’t need to pretend that we don’t know what’s going to happen. Because many of us are clapping hands, one company wants to refine, one company wants to stock, one company wants to do the logistics of distribution, and one company wants to fix prices. So that one company is going to be both a businessman and a regulator. And so many Nigerians don’t seem to understand the dynamics of the difficulty,” he said.

Reflecting on what happened in the cement industry, he said, “Because I want to draw your attention to the fact that we also have similar situations in our cement industry, where you are seeing the same trucks supplying cement.

“So, I’m sure you have seen in all your homes and villages and cities, those small, small container shops that are for cement. So, where the cement is not produced from the factory, and also distributed to those very critical distribution centres, have you bought cement for N115 again? From N115, we are buying now for 10,000 plus,” he said.

He raised concerns over what he described as Dangote’s attempt to dominate the market, noting that retail outlet operators are losing as much as N80 per litre due to sudden price adjustments.

The PETROAN boss argued that with a production capacity of 650,000 barrels per day, which has now been upgraded to 700,000 barrels, the Dangote refinery should be competing with global refineries, and not operate as a distributor in the downstream, adding that NOGASA, NATO, and PTT could effectively do the job of distribution of the products.

“Just yesterday, some of them began selling products at N817 per litre. That represents a loss of over N80 per litre for filling station operators. When you consider the volume of product involved, it becomes clear that, very soon, salaries may not be paid.

“The association is therefore calling on the Nigerian Midstream and Downstream Petroleum Regulatory Authority and the Minister of State for Petroleum Resources to urgently implement pricing regulations, reinforce market oversight, ensure crude oil is accessible to local refineries, and take deliberate steps to protect existing jobs in the sector,” Gillis Harry noted.

Dangote reacts

A senior official of the Dangote Group expressed surprise that an organisation could threaten to disrupt fuel supply because an individual wants to distribute fuel free of charge to Nigerians.

“Why would they want to disrupt? Somebody wants to distribute fuel for free (without the cost of logistics). We are not asking for money. We are saying part of the reason why PMS is expensive is because of the logistics, and we are removing the cost. We are removing that money. So, why are they angry? Why the disruption, if not anti-Nigeria? They hate Nigeria; they don’t want this country to prosper.

“If someone wants to do something free, we are not asking for money. We are not saying, once we use our truck to supply you with PMS, you are going to pay us money. Why are you angry that an individual, a private sector person, wants to do that? Why are you angry? Why are you pained? And is this market not big enough for everybody to survive?” the official, who spoke in confidence because he was not permitted to talk on the matter, asked.

The official discountenanced claims that NOGASA members would lose their source of livelihood.

“How will they lose their job? The market is big enough. You heard what the NNPC man said yesterday about the fact that they are not willing to sell the Port Harcourt refinery. And there are other modular refineries everywhere. Some people are working. They will still be in use. They will still be useful.

“Okay, we are starting with 4,000 trucks. There are 774 Local Governments in Nigeria. Can the 4,000 trucks really go around the 774 LGs? No. Why are we deceiving ourselves? Why are we anti-Nigeria? Why don’t we want this country to progress and develop? Absolutely, I don’t see any need for them to go on strike. Nobody’s threatening anybody. Nobody’s interested in a monopoly. This country can thrive with everybody doing their business. Dangote is not saying, ‘don’t do your business,” the official stated.

IPMAN National Vice Chairman, Hammed Fashola, said he would not know whether or not NOGASA members have the strength to disrupt fuel supply in Nigeria.

According to him, everybody is trying to survive in the oil business as they perceived Dangote’s plan as a means of cutting them out of business.

“Everybody wants to make sure they remain in business. You know, there have been a lot of reactions to that move by Dangote. Naturally, transporters will not be happy, and intermediaries won’t like it. You know this thing has a value chain, and there are a lot of people playing one role or the other in the supply chain.

“I believe Dangote, too, will be listening to the stakeholders. So, I think at the end of the day, everybody will be on the same page. Let’s see what happens. I don’t know their strength. I told you I’m not a member. So, I cannot tell if they have the strength to disrupt fuel supply. Before they can say they want to disrupt the supply, I think maybe they have the capacity. But let’s wait and see,” Fashola said.

Depots hike prices

Meanwhile, depot prices for petrol spiked by up to seven per cent, from the N815 per litre it sold to customers on Wednesday to N870 per litre on Thursday. This was as Dangote refinery abruptly suspended petrol sales across its terminals, deepening supply uncertainty and accelerating price movements nationwide.

In a notice titled “Important Update on DPRP Collection Account for PMS”, Dangote refinery instructed marketers to halt all payments for PMS loading at its gantry, effectively freezing further allocations. “Please be advised that, effective immediately, all payments to the DPRP collection account for PMS gantry should be placed on hold,” the internal memo read. “Further updates will be communicated shortly.”

Earlier this week, importers dropped petrol prices below the price offered by the Dangote Petroleum Refinery, sparking a new wave of competition.

But fresh findings have now revealed that depot owners have hiked their prices based on the increased crude price, indicating a possible increase in pump price next week nationwide. Findings by our correspondent using petroleumprice.ng showed that six depots including NIPCO, Aiteo, Rain oil, MenJ, Sahara and Aipec have all effected an increase to N870 per litre. The Dangote refinery depot sold slightly less at N865 per litre.

FOLLOW US ON:

FACEBOOK

TWITTER

PINTEREST

TIKTOK

YOUTUBE

LINKEDIN

TUMBLR

INSTAGRAM