The Federal Government has projected total revenue of N50.74 trillion for 2026, alongside a targeted economic growth rate of 4.68 per cent, while its proposed 2026 deficit has risen so sharply that it now exceeds the entire national budget of 2022 by N2.78tn.

This deficit likely means the government plans to borrow about 16.1 per cent more than what the entire country spent in 2022. The scale of the gap, combined with the high debt service bill, signals a more difficult fiscal year ahead.

Experts noted that Nigeria risks sliding into deeper fiscal stress if the government does not tighten its expenditure planning, boost efficiency and re-establish a credible budget calendar. They warned that rising deficits, unpredictable budget cycles and mounting debt obligations could undercut the fragile economic stability recorded in recent months and heighten pressure on households and businesses in 2026.

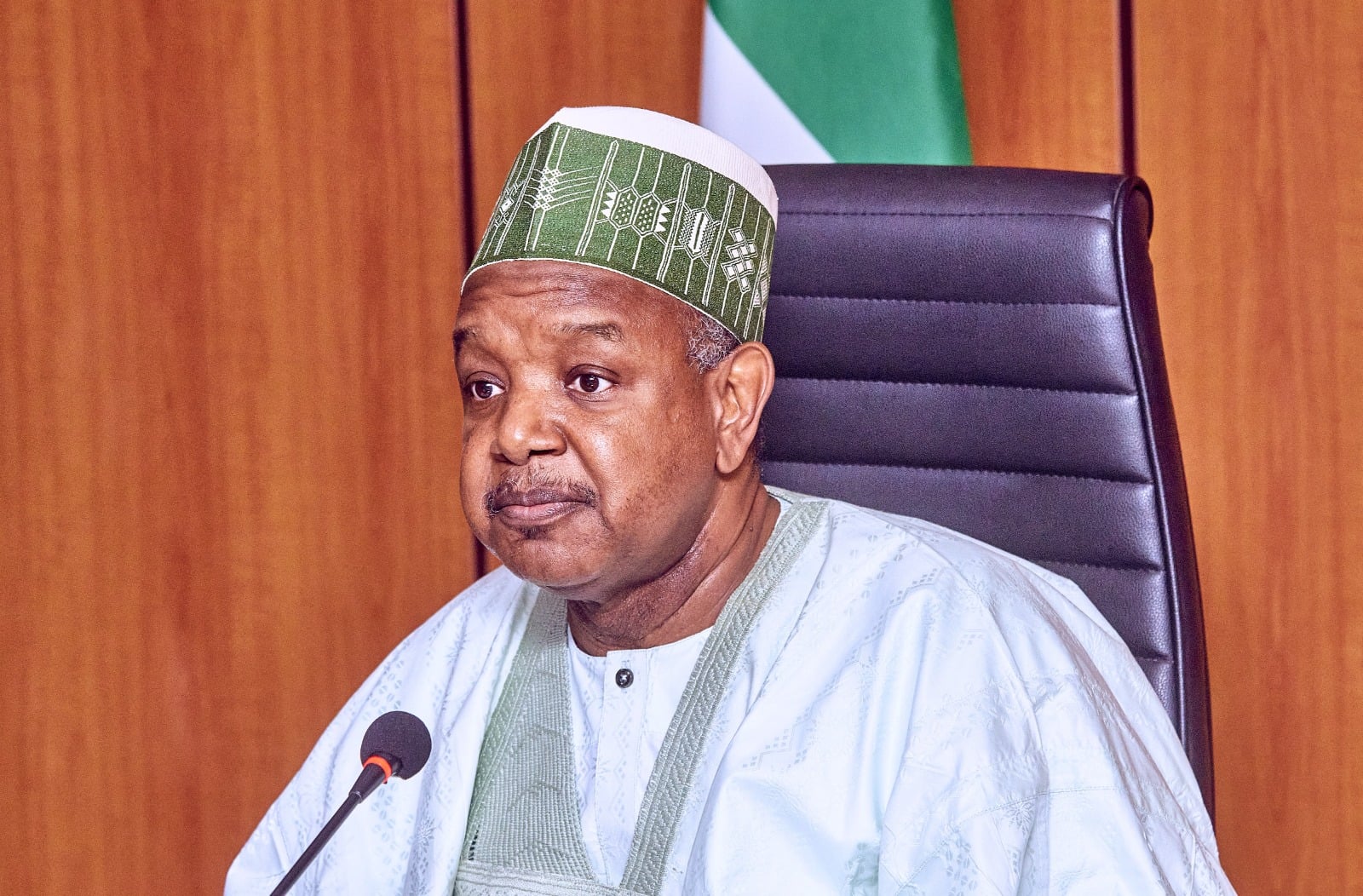

This comes after the Federal Executive Council approved the 2026 to 2028 Medium-Term Expenditure Framework and Fiscal Strategy Paper on Wednesday. The Minister of Budget and Economic Planning, Atiku Bagudu, briefed State House correspondents after the meeting and confirmed that the document would be forwarded to the National Assembly on Monday.

Bagudu said the draft was built on a cautious oil price benchmark of 64.85 dollars per barrel and an exchange rate estimate of N1,512 to one dollar for 2026. He explained that the assumptions followed consultations with ministries, private sector operators, civil society groups and development partners.

He revealed that the government adopted dual crude production figures for the first time. The oil industry has been tasked to deliver 2.06 million barrels per day, while a more conservative benchmark production of 1.8 million barrels per day will guide the budget.

The difference provides a safety buffer of 12.6 per cent in case of output disruptions. Bagudu said the benchmark price of $64.85 was lower than what Nigeria usually earns for Bonny Light crude but insisted that caution was necessary.

The minister projected a growth rate of 4.68 per cent for 2026 and warned that increased political spending in the run-up to the elections could heighten pressure on the exchange rate. He said, “Given that 2026 is a pre-election year, there is a lot of election activity spending that can typically affect the exchange rate.”

He listed the expected Federation revenue for 2026 as N50.74tn, with N22.60tn going to the Federal Government, N16.30tn to states, and N11.85tn to local governments. The Federal Government’s share of revenue from all sources is projected at N34.33tn, including N4.98tn expected from government-owned enterprises.

Bagudu said the figure is 16 per cent lower than the 2025 revenue estimate. He outlined key spending areas, including statutory transfers of about N3tn, non-debt recurrent expenditure of N15.27tn, and a debt service burden of N15.91tn.

Based on the proposed spending envelope of N54.43tn, debt service alone will consume 29.2 per cent of the entire 2026 budget. This means that almost three out of every ten naira the government spends next year will go to servicing debt.

The projected deficit of N20.10tn accounts for 36.9 per cent of the entire spending plan. The size of the shortfall means Nigeria intends to borrow more than one-third of its planned expenditure for the year. The contrast with earlier budgets is striking. President Bola Tinubu signed the 2025 budget of N54.99tn into law.

Although slightly larger than the 2026 spending proposal, the 2025 plan carries a lower deficit of N9.22tn and a debt service provision of N14.32tn. The deficit planned for 2026 is more than double the current year’s level and reflects an increase of 118 per cent.

The amended 2022 budget under former President Muhammadu Buhari stood at N17.32tn. Debt service at the time was N3.98tn. The 2026 projection of N15.91tn is N11.93tn higher, representing an increase of about 299 per cent in four years.

Recurrent spending has also risen from N7.11tn in 2022 to N15.27tn proposed for 2026, an increase of 115 per cent, while capital spending has grown much more slowly. Bagudu said the new framework reviewed the performance of the 2025 budget and incorporated inputs from stakeholders across critical sectors.

He added that President Tinubu had secured support from the National Economic Council for closer alignment between fiscal and monetary policies. “[The President] called for more collaboration and coordination between fiscal and monetary policies and sought the approval of the National Economic Council to invest more in security spending, in particular, the rehabilitation of training institutions of security agencies,” Bagudu said.

He added that FEC endorsed increased “Federation vigilance to eliminate revenue loss from illegal activities in the oil and gas sectors as well as critical mineral sectors,” alongside a push for “critical minimum transformational investment for infrastructure” through the Renewed Hope infrastructure funding and measures to boost domestic production.

The minister also revealed that the memo to FEC was presented by the Director-General of the Budget Office, supported by his team and the Economic Management Team, after “technical discussions, bilateral engagement as well as expert consultations” with stakeholders to ensure the framework reflects “collective aspiration.”

The MTEF/FSP, a statutory three-year fiscal guide, sets the assumptions that will underpin the 2026 Appropriation Bill, including oil/output benchmarks, revenue profiles, deficit limits, and the spending mix.

Economists react

Economists have raised concerns over the Federal Government’s plan to run a N20.10tn deficit in 2026, saying the scale of borrowing, the timing of budget preparation, and the persistent breakdown of Nigeria’s fiscal calendar could undermine macroeconomic stability and worsen investor uncertainty.

Speaking in separate interviews with The PUNCH on Wednesday, the experts said the deficit, which represents more than one-third of the proposed N54.43tn spending envelope, raises fresh questions about debt sustainability, fiscal discipline and the government’s ability to manage inflationary and exchange rate pressures in 2026.

The Chief Executive Officer of the Centre for the Promotion of Private Enterprise, Dr Muda Yusuf, said Nigeria must be cautious not to destroy the fragile stability achieved in recent months.

He warned that high deficits and rising debt levels pose a serious threat. Yusuf said he was worried about what he described as the risk of a debt trap, stating that “we need to worry about debt sustainability” because “high levels of deficits and high levels of debt… can choke the fiscal space and lead to a kind of vicious circle of debt.”

He explained that Nigeria has only recently regained some macroeconomic footing and that any disruption could quickly worsen inflation and exchange rate pressures.

According to him, “we already have a reasonable level of macroeconomic stability” and “once we lose that recovery… it will create even more problems because that is where the problem of inflationary pressure will come and that is where the pressure on the exchange rate will come.”

Yusuf said the government had claimed that revenue performance was improving and urged it to take advantage of the gains to cut the deficit rather than expand it. He argued that Nigeria must “leverage on the improved revenue situation to moderate the level of deficit and the level of debt exposure so that we don’t put at risk the macroeconomic stability that we have achieved.”

He added that the systemic effects of macro instability would be severe and urged the government to handle deficit planning with extreme caution.

Another economist and professor at the Olabisi Onabanjo University, Sheriffdeen Tella, faulted the basis of preparing the 2026 budget when implementation of the 2025 budget had barely begun. Tella questioned how the government arrived at a deficit of N20tn when, according to him, the 2025 budget started late and had not generated any performance indicators to justify new projections.

He said he found the 2026 deficit troubling because “the budget of 2026 is supposed to be premised on the implementation or performance of 2025,” yet “they have just started implementing the 2025 budget… in December 2025.”

Tella added that “there is no basis for any budget because what they had, they have not implemented” and argued that the government should have rolled over the 2025 plan into 2026 instead of preparing a fresh document.

The professor expressed concern that Nigeria risked operating multiple budgets in the same year, calling it a sign of fiscal disorder. According to him, “putting a deficit that is more than the budget of a year… means there is no basis for that. They just cook up figures and put them out to the public, which is wrong.” He described the situation as unfortunate and said the credibility of the budgeting process was being eroded.

The National President of the Nigerian Economic Society, Professor Adeola Adenikinju, also criticised the government for drifting away from the January to December budget cycle. He said the timing of the MTEF FSP approval showed that Nigeria was again running behind schedule, which undermines predictability and complicates economic planning.

Adenikinju said, “The 2026 budget should have been in the National Assembly for consultation so that we can keep to this January 1st thing. That makes our fiscal system predictable.” He argued that the late budget presentation prevents the National Assembly from carrying out proper scrutiny.

The economist said the rush to approve budgets “does not allow for proper analysis” and prevents ministries and departments from fully defending their plans. He warned that the practice was creating a disorganised fiscal environment. According to him, “we are running two or three budgets in the same year,” and the pattern “makes the whole process very disorganised.”

Adenikinju expressed concern about the scale of the proposed 2026 deficit and questioned how the government planned to finance it. He reminded the government that the Fiscal Responsibility Act limits the deficit to three per cent of GDP.

He said, “Our budget deficit should stay below three per cent of GDP… so if you are going beyond that, really you are violating the law.” He added that borrowing heavily from domestic markets would crowd out the private sector and raise interest rates.

In his words, “if you borrow from the public… interest rates will go up” because government borrowing increases demand for credit and banks may prefer to lend to the government rather than to businesses. He said this would slow investment and worsen economic hardship.

Adenikinju also questioned the quality of government spending. He said debt was not necessarily bad if it funded productive projects, but Nigeria’s capital releases often come too late to deliver meaningful development outcomes.

He noted that “if for a whole year, you are releasing your capital budget two months to the end of the year… contractors are having a lot of issues”, yet the government insists that revenue projections are being met. He warned that persistent borrowing without a clear developmental impact would worsen inflation and currency instability.