The automobile market is facing one of its most difficult periods in recent years, as data from the National Bureau of Statistics show that passenger car importation has continued to decline sharply, reflecting a broader collapse in consumer purchasing power and business activity across the transport sector.

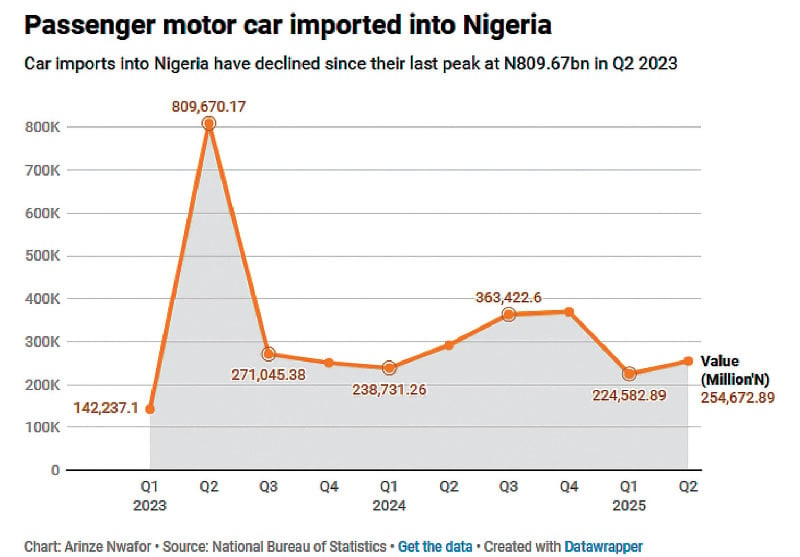

According to the National Bureau of Statistics’ foreign trade data, passenger motor car imports in the first six months of 2025 stood at N479.26bn, a 9.69 per cent drop from the N530.67bn recorded in the same period of 2024. The downward trend is consistent with the previous year’s figures, when the total import value fell from N1.47tn in 2023 to N1.26tn in 2024, representing a 14.29 per cent decline.

A quarterly breakdown of the data showed that in Q1 2025, the country imported passenger vehicles worth N224.58bn, while Q2 2025 recorded N254.67bn. By contrast, Q1 2024 saw imports valued at N238.73bn, and Q2 2024 stood at N291.93bn, underscoring the consistent slowdown in vehicle importation since 2023.

Dealers and analysts told The PUNCH in phone interviews that the trend is not a surprise, given the persistent foreign exchange challenges, high import duties, and the low purchasing power of Nigerians, which have combined to make car ownership increasingly unaffordable for both households and businesses.

Dealers hit hard

A vehicle sales expert, Cletus Aregbesola, said the high cost of the dollar and steep customs tariffs remain the biggest reasons for the continued fall in car imports.

“You cannot separate Nigeria from the global market. Even though the dollar has stabilised, it is still high. So by the time you bring in a car, you already know how much you will pay your OEMs, and that reflects on the final price,” Aregbesola said.

He noted that import duties have become unbearable for dealers. “Custom duty is so high for both ‘Tokunbo’ (fairly used) and new cars. You’re paying between 75 and almost 100 per cent on the car. The tariff used to be lower for Tokunbo cars, but now both categories are almost the same,” he explained.

Aregbesola noted that this has forced many potential buyers to postpone new purchases and focus instead on maintaining their existing vehicles. “People are no longer buying new cars. They prefer to maintain what they have. It doesn’t make sense to sell your car at N3m only to buy a new one at N12m,” the car expert added.

He added that the surge in fuel costs has further discouraged ownership. “Fuelling is also a major factor. With the price of petrol rising, people now ask themselves if they can sustain the cars they own. Most families are not thinking about cars now; they’re focused on feeding, rent, and school fees.”

Worse, the decline in car importation has hit the profitability of auto businesses, leading to layoffs and restructuring. Aregbesola revealed that “many auto companies that used to sell 2,000 or 3,000 units annually are now struggling to sell 500. Corporate fleet purchases, which used to support bulk sales, are now rare. When those orders don’t come, the businesses struggle.”

He said that, to survive, dealers have begun embracing Chinese car brands, which are relatively cheaper compared to European or American vehicles.

“The market is now pro-Chinese vehicles. Just three years ago, there were very few on Nigerian roads, but today that’s what companies and even some government agencies can afford. Some go for N30m to N40m, while equivalent European models cost over N100m,” he noted.

He added that the focus on cheaper brands has helped businesses “cushion the impact” of falling demand, though profits remain thin.

Many car dealers have diversified into after-sales and maintenance services to stay afloat, given that more Nigerians are choosing to repair rather than replace their cars. “We now emphasise after-sales. That’s where most of the income comes from,” Aregbesola maintained.

Some companies have also reduced their workforce. “You can’t run away from it. You have to reshuffle staff, reduce your load, and become leaner to survive,” he said.

Meanwhile, the President of the Importers Association of Nigeria, Kingsley Chikezie, after a failed attempt to contact the car import group of his association, corroborated the challenges faced by car importers. While the IMAN president noted that he is “not involved in the importation of cars”, he confirmed that “there are a lot of issues in car importation in Nigeria.”

Chikezie said, “The income per capita in Nigeria is so small that somebody cannot save up N6m to N10m to go and buy a Corolla car.”

FX, tariffs choke demand

Economist and former President of the Chartered Institute of Bankers of Nigeria, Prof Segun Ajibola, said the continued decline in car imports reflects the harsh realities of the economy.

“There is a decline in the value of our local currency, which has jacked up the landing costs of imported goods. Since there is a limit to the purchasing power of end users, most car users now rely more on repairs and refurbishing old cars instead of buying new ones,” he said.

Ajibola noted that the import data likely does not include the large number of Tokunbo cars that enter the country through unofficial channels. “We are all aware that there is large-scale smuggling of Tokunbo cars into Nigeria. Those who evade customs duties can sell at cheaper prices, which further distorts the market,” he explained.

He observed that corporate institutions have also cut back on new vehicle purchases. “Many companies that used to buy new cars for staff or management now settle for Tokunbo vehicles. Maintenance and refurbishment businesses are booming because people are trying to stay in motion without buying new cars.”

Despite government initiatives like the Renewed Hope Automobile Credit Fund and the Nigeria Consumer Credit Corporation, stakeholders say access to affordable credit remains a major problem.

Ajibola said, “If they afford people a credit line to buy cars, can they pay back? Why will I take an N50m or N100m loan in Nigeria today just to buy a car? I would rather look for a Tokunbo that costs N10m or N20m. So affordability is still a big issue.”

He added that the nature of vehicles as “movable assets” also discourages lenders. “A car can disappear, have an accident, or lose value fast. So there’s a limit to how far banks and credit institutions can go,” he said.

He argued that Nigeria must develop its own local automobile industry to reduce reliance on imports. India has its own brands. Korea has its own mix. “Why should Nigeria, after 65 years of independence, still depend on foreign countries for cars?” the economist queried.

Local production

While the Federal Government has made moves to stimulate local production through credit schemes and assembly plant incentives, stakeholders say progress remains slow.

The Centre for the Promotion of Private Enterprise, in a policy brief on Nigeria’s 2025 second-quarter Gross Domestic Product report, listed motor vehicle assembly among the “challenged and recessionary sectors”.

According to CPPE Director Muda Yusuf, “The motor vehicle assembly sector reversed Q1 gains to contract by 1.5 per cent, reflecting import pressure and weak demand. Sustained policy support, including government procurement of locally assembled vehicles, is essential for revival.”

An earlier commentary made available to The PUNCH by the Executive Director of the Motorcycle Manufacturers Association of Nigeria, Lambert Ekewuba, confirmed that local production was below the optimal level.

Ekewuba had called for the Federal Government to partner with the Original Equipment Manufacturers to accomplish a successful component deletion programme, which would pave the way for a lucrative local auto manufacturing sector.

He said, “Nigerian motorcycle manufacturers are not OEMs. That is, we don’t have the original manufacturing equipment. We are not the owners of the motorcycles. You must convince the owners to establish their technology here in Nigeria.”

Meanwhile, CPPE director Yusuf explained that only stable policies can address the challenges facing the sector, ranging from smuggling to high energy costs. “Without consistent government patronage and stable policies, these assembly plants will continue to struggle,” he warned.

The Federal Government, through the National Automotive Design and Development Council and CrediCorp, launched initiatives to ease vehicle ownership and stimulate local production. The PUNCH reported in 2024 that both agencies unveiled an N20bn consumer credit fund to help Nigerians purchase locally assembled vehicles.

The initiative, announced during a signing ceremony with nine local manufacturers, including Innoson, Nord, CIG GAC, PAN, Mikano, Jets, NEV, and DAG, was intended to reduce import dependency and support local assemblers.

By March 2025, CrediCorp expanded the scheme to a N100bn credit initiative aimed at making vehicle ownership more accessible. The PUNCH reported the CrediCorp Chief Executive Officer, Uzoma Nwagba, said, “Our goal is to expand access to consumer credit for Nigerians to improve their quality of life. This includes financing for vehicles, mobility, solar panels, and home improvements.”

The impact of these programmes is yet to be felt in the market. The PUNCH discovered that most Nigerians are unable to meet the repayment conditions, even if they are available. Thus, the market remains dry.

Dealers and economists agree that the decline in car imports is not only a reflection of weak demand but also a sign of deeper structural challenges in Nigeria’s economy, high inflation, rising taxes, and limited credit access.

Aregbesola said the government must rethink its import and tariff policies if it wants to revive the sector. “The tariff on vehicles needs to come down. Even local assemblers are not benefiting because the cost of setting up an assembly plant is still high,” he said.

He also urged the government to strengthen local production through consistent incentives and power supply. “If the government buys locally assembled vehicles for official use, it will create the demand that keeps factories alive.”

Ajibola, however, cautioned that no short-term measure will fix the situation without addressing purchasing power. “Until the income level of Nigerians improves, no credit scheme or tariff reduction will make car ownership easier. People simply cannot afford it,” he said.

With the average new vehicle now costing between N40m and N100m, and used cars between N10m and N25m, the dream of car ownership is fast slipping beyond the reach of most Nigerians.

As the data show, the sector’s contraction is not just a statistical trend; it represents the growing economic strain facing households and the fading shine of a once vibrant automobile trade.

punch.ng

FOLLOW US ON: